- SPEECH

Central bank digital currencies: a monetary anchor for digital innovation

Speech by Fabio Panetta, Member of the Executive Board of the ECB, at the Elcano Royal Institute, Madrid

Madrid, 5 November 2021

The ongoing digitalisation of our economy is leading to far-reaching changes in many areas of our lives. Payments are no exception: innovative forms of private digital money are emerging in response to changing needs, which are transforming how we pay and the payment landscape more broadly.

These developments touch at the core of central banks’ mandates as issuers of sovereign money. And central banks around the world are looking for ways to respond. The ECB is exploring whether to issue a digital euro – a digital form of central bank money for people and businesses to use in retail payments.

It has been argued that such a central bank digital currency (CBDC), if issued, would be redundant given the vast supply of private digital monies available, including bank deposits, credit cards, electronic money and mobile applications, and possible future payment solutions based on stablecoins.[1]

Today, I would like to argue that, actually, monetary stability and the smooth functioning of payment systems ultimately depend on everyone being able to widely access and use sovereign money. And there is no reason why this should not hold true in the digital era. But this requires central banks to evolve alongside changing technologies, payment habits and financial ecosystems. Let me explain why.

The importance of central bank money as a monetary anchor for payments

People’s confidence in private money is underpinned by its convertibility on a one-to-one basis with the safest form of money in the economy – central bank money, the monetary anchor – and hence with other regulated forms of money.[2] Central bank money is the only money whose face value is intrinsically guaranteed.[3] Private issuers have to rely on convertibility, as their money is exposed to operational, credit, liquidity and market risks. These risks are reduced through public policy safeguards, such as financial supervision, capital requirements and deposit insurance.

Convertibility at par provides confidence in private money because it reassures us regarding its ultimate value and its usability for payments. For example, when we go to our bank’s cash machine and convert our deposits into an equivalent amount of cash, we are safe in the knowledge that our deposits have kept their value. By going to a cash machine on a recurring basis and withdrawing cash each time, we build confidence that this will continue to happen in the future. And we agree to store and use our money through private intermediaries because we are ultimately reassured that we will get cash if we ask for it, and therefore that we will be able to make payments even if our money cannot be used directly in its private form. Runs on private money start when this confidence in convertibility disappears, triggering a flight to safety.[4]

Convertibility into central bank money is therefore necessary for confidence in private money as both a means of payment and a store of value. By providing a monetary anchor, central bank money plays a key role in maintaining a well-functioning payment system and financial stability and ultimately trust in the currency. This in turn is a pre-condition for preserving the transmission of monetary policy, and hence for protecting the value of money.

Maintaining the monetary anchor in the digital age

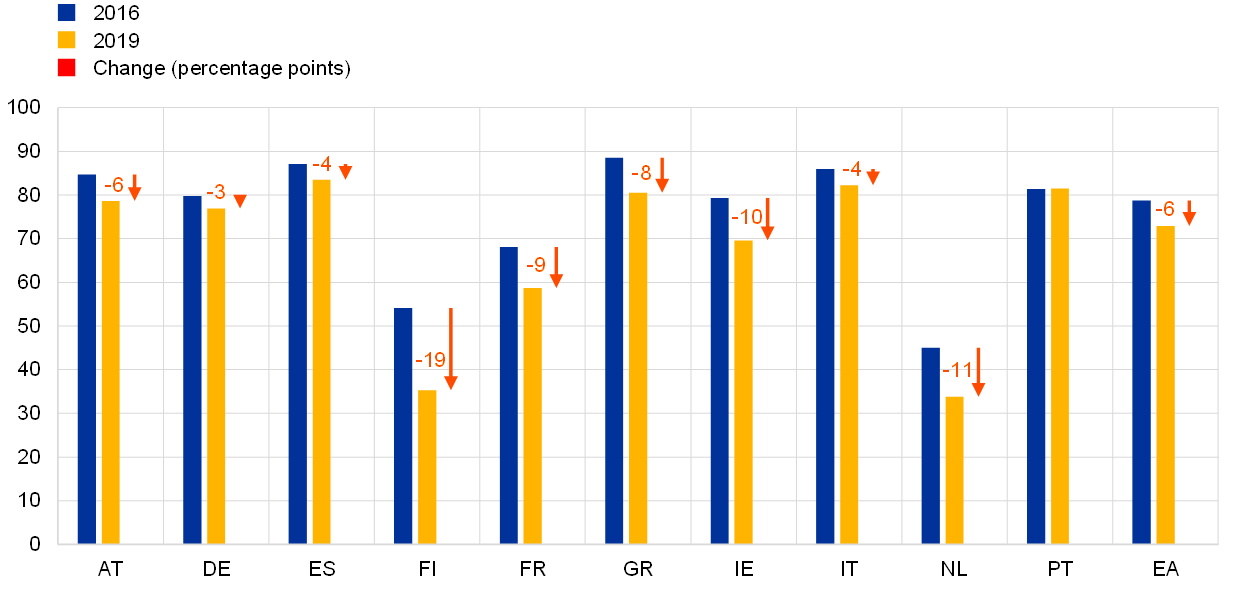

Today we have access to central bank money in the form of cash. The importance of cash in payments is declining, however, as people increasingly prefer to make digital payments and shop online (Chart 1).

Chart 1

Change in the share of the number of cash transactions by consumers in selected euro area countries

(percentage)

Sources: ECB, De Nederlandsche Bank and Dutch Payments Association, and Deutsche Bundesbank.

Notes: Data for 2016 are from the study on the use of cash by households (SUCH) presented in Esselink, H. and Hernandez, L. (2017), “The use of cash by households in the euro area”, Occasional Paper Series, No 201, ECB, Frankfurt am Main, November; data for 2019 are from ECB (2020), “Study on the payment attitudes of consumers in the euro area (SPACE)”, Frankfurt am Main, December. “EA” refers to the euro area average (all 19 member countries). Values from the first survey (2016) only include payments at the point of sale (POS), while the SPACE values include both POS and person-to-person (P2P) payments. Since P2P payments are mostly made in cash according to the SPACE results, values may slightly underestimate the difference between SUCH and SPACE. For Germany, data for the SUCH study were for 2014. Hence, the chart compares the shares of cash transactions in Germany measured in 2014 with those measured in 2017.

If given the choice, almost half of euro area consumers would prefer to pay with cashless means of payments, such as cards.[5] Internet sales in the euro area have doubled since 2015.[6] Cash is increasingly used as a store of value and decreasingly as a means of payment, a trend that the pandemic has accelerated.[7] And while the cash stock has continued to increase and has even been boosted by the pandemic owing to higher precautionary demand for cash, only about 20% of the cash stock is now used for payment transactions, down from 35% fifteen years ago.

If these trends were to persist and accelerate, cash would end up losing its central role and becoming a means of payment that people would be reluctant to use because it would be less adapted to their needs. Just as the postage stamp lost much of its usefulness with the arrival of the internet and email, so too could cash lose relevance in an economy that is becoming increasingly digital.

The upshot is that if this scenario were to materialise, it would weaken the effectiveness of central bank money as a monetary anchor. Even central banks’ pledge to continue to supply cash would do little to guarantee that cash would remain an effective anchor if there was insufficient demand for it as a means of payment.

While banks could continue to hold central bank money in the form of reserves, this may not prove sufficient to fully preserve the monetary anchor role of central bank money. People would be unable to use central bank money as means of exchange and would thus have little incentive to hold it. This would weaken the unit of account role of sovereign money.[8] If the currency is not demanded by the public, the mere announcement that the central bank would make it available would not be enough to preserve its role in the economy.

Some have also suggested that innovative private payment solutions such as stablecoins could, if properly regulated, make CBDCs superfluous.[9] But confidence in stablecoins also depends on convertibility with central bank money,[10] unless stablecoin issuers are granted access to the central bank balance sheet, allowing them to invest their reserves in the form of risk-free deposits at the central bank. However, this would amount to outsourcing the provision of central bank money to stablecoin issuers and risking a corresponding reduction in monetary sovereignty.[11]

Without central bank money to provide an undisputed monetary anchor, people would have to monitor the safety of private money issuers in order to value each form of money, undermining the singleness of the currency. Indeed, there were recurrent crises in the past when different forms of private money coexisted in the absence of sovereign money, such as during the free banking episodes of past centuries.[12] History shows that financial stability and public trust in money require a widely used public money alongside private monies.

As people start to use cash more as a store of value rather than a means of payment, having a digital euro would enable them to continue using central bank money as a means of exchange in the digital era. A digital euro and cash would complement each other and ensure that central bank money remains a monetary anchor for the payments ecosystem and continues to serve as a means of exchange, a store of value and a unit of account.

For this to come about, a large share of the population would need to use the digital euro on a regular basis. It would not be necessary for them to use the digital euro for most of their day-to-day payments. What matters is that such regular use would give people the confidence that they can always use the digital euro for payments if they wanted or needed to.

To this end, a digital euro would have to be designed in a way that makes it attractive enough to be widely used as a means of payment, but at the same time prevents it from becoming so successful as a store of value that it crowds out private money and increases the risk of bank runs.

The conditions for success of a digital euro

The previous discussion suggests that in a digital world CBDCs are necessary to guarantee the smooth functioning of the payment market, especially in periods of crisis. But this does not mean that the success of CBDCs should be taken for granted. Users may lack sufficient incentives to fully appreciate the public benefit created by the availability of a CBDC and – given the vast supply of private digital monies – could express insufficient demand for it.

While we have discussed at length the possibility of a digital euro being paradoxically “too successful”,[13] we need to devote just as much attention to the risk of it not being successful enough.

So what are the conditions for success?

Besides having an intrinsic appeal, a successful digital euro would need to be widely accessible and usable. In other words, while people would find a digital euro attractive because of its unique property as the only riskless digital form of money, they would also need to be able to use it easily wherever they can pay digitally.

Consumers will only use a digital euro if merchants accept it, and merchants will want to be reassured that consumers want to use it. Intermediaries, in turn, will only follow suit if there is compelling evidence that the benefit of distributing it outweighs the cost of doing so. Developing a convincing value proposition for all stakeholders is therefore critical to the digital euro’s success. This is a key part of the investigation phase of the digital euro project which we started in October. The ECB and the European Commission are together reviewing at the technical level a broad range of policy, legal and design questions emerging from a possible introduction of a digital euro, including the role that legal tender status might play in achieving the desired network effects.

For consumers, the digital euro would offer a cost-free and convenient way to pay digitally anywhere in the euro area. It would also increase privacy in digital payments: as a public and independent institution, the ECB has no interest in monetising users’ payment data and it could only process them to the extent necessary for the functions of the digital euro, in full compliance with public interest objectives and EU legislation.[14] The ECB could use privacy-enhancing techniques while still complying with regulations on anti-money laundering and combating the financing of terrorism.[15]

For payees such as merchants and small businesses, a digital euro would be an additional means to receive customer payments through the instant reception of risk-free money. Moreover, a digital euro could contain the cost of payments through its potential to mitigate the market power of dominant digital payment providers, which already control around 70% of European card payments.

The digital euro should not be seen as a competitor to digital payment services offered by the private sector. Intermediaries could play an integral role in the onboarding and provision of front-end services to ensure a pan-European reach. They would have the opportunity to distribute the safest and most liquid form of money, and could develop new services with “digital euro inside” – such as providing credit facilities to digital euro users or innovative value-added services in the form of automated or conditional payments − thereby generating additional revenues.

This would help level the playing field by making it easier for banks – including small ones, whose customers may have limited access to innovative products – and fintechs to compete with big tech firms, which are expanding into payments and financial services. It would support the competitiveness of European payments, making them cheaper and more efficient for users.

Finally, by providing a fast, cheap and safe digital means of payment, a digital euro would support the euro’s international use and Europe’s autonomy in global payments[16]. Making it accessible to non-residents and interoperable with other CBDCs could facilitate cross-border payments, which are currently fraught with high costs, low speeds and limited access.

A digital euro would thus expand payment options in the digital age without crowding out sound private payment solutions. And it would provide a monetary anchor to the rapidly evolving European digital payment ecosystem, underpinning trust and stability in digital payments.

Conclusion

Let me conclude.

It has been argued that the ample availability of private digital means of payment would make central bank digital currencies superfluous. However, this ignores the essential role that central bank money plays in the payment system and the financial sector as a whole.

Central bank money provides the reference value for all other forms of money in the economy. Playing a crucial role in underpinning confidence in the currency and in the smooth functioning of the payment system, central bank money is necessary for preserving the transmission of monetary policy, hence for protecting the value of money and monetary sovereignty.

With digitalisation at full speed, central banks must prepare for a digital future in which demand for cash as a medium of exchange may weaken, requiring the convertibility of private money into cash to be complemented by convertibility into central bank digital money.

This is the primary reason why the ECB would issue a digital euro. Now that people are increasingly shifting towards digital payments, we need to ensure that they can readily access and use central bank money in digital form too. We are working to make the digital euro an attractive means of payment for everyone – households, firms, merchants and intermediaries alike – so that it can play its intended role as the necessary monetary anchor for the digital era.

- Waller, C.J. (2021), “CBDC: A Solution in Search of a Problem?”, speech at the American Enterprise Institute, Washington, D.C., August.

- One-to-one convertibility with the common monetary anchor is what makes these regulated forms of money convertible with each other at par and is why they are perceived as interchangeable when making payments.

- Central banks have a mandate to preserve price stability not just for the money they issue but for the currency as a whole, with a view to preserving its purchasing power.

- In practice, many people may not fully understand the difference between commercial bank money and central bank money, or why only central bank money is riskless. However, they do know that banknotes protect them from their bank defaulting. Therefore, repeatedly going to the cash machine provides tangible proof that the money they keep in their bank is safe.

- ECB (2020), “Study on the payment attitudes of consumers in the euro area (SPACE)”, December.

- In August 2021 the Eurostat index of retail sales via internet or mail order houses (seasonally and calendar adjusted, index 2015=100) stood at 206.1.

- Zamora-Pérez, A. (2021), “The paradox of banknotes: understanding the demand for cash beyond transactional use”, Economic Bulletin, Issue 2, ECB, Frankfurt am Main.

- Between 1999 and 2002 electronic money was held in euro, whereas cash was still held in national currencies. Most of us in the euro area only started counting in euro when euro cash was introduced in 2002 and replaced national currencies as means of payment. This highlighted the strong connection between a monetary anchor that is effectively used as a means of exchange and as a unit of account. In history, sovereign money was at times used as unit of account but not as a medium of exchange. This was for example the case of the livre, the “imaginary money” introduced by Charlemagne in the monetary reform of the eighth century, named after the libra (pound), the sovereign money introduced by the ancient King of Rome Servius Tullius in the sixth century BC. The livre was never coined and never circulated. However, it had a fixed conversion rate with another form of sovereign money, the denier (1 livre was equal to 240 deniers), which was actually coined and actively used as means of exchange. See Einaudi, L. (1936), “Teoria della moneta immaginaria da Carlo Magno alla rivoluzione francese”, Rivista di storia economica, Vol. 1, pp. 1-35; Cipolla, C.M. (2001), Le avventure della lira, Il Mulino, Bologna.

- Quarles, R.K. (2021) “Parachute Pants and Central Bank Money”, speech at the 113th Annual Utah Bankers Association Convention, Sun Valley, Idaho, June.

- The value of a stablecoin is linked to one or more other assets, including currency in the form of commercial bank deposits. They can therefore be low risk, but not riskless.

- Panetta, F. (2020), “From the payments revolution to the reinvention of money”, speech at the Deutsche Bundesbank Conference on the “Future of Payments in Europe”, November.

- Eichengreen, B. (2019), “From commodity to fiat and now to crypto: what does history tell us?”, NBER Working Paper Series, No 25426, January; Rolnick, A.J. and Weber, W.E. (1983), “New evidence on the free banking era”, American Economic Review, Vol. 73, No 5, pp. 1080-1091.

- Panetta, F. (2021) “Evolution or revolution? The impact of a digital euro on the financial system”, speech at a Breugel online seminar, February; Bank for International Settlements (2021), “Central bank digital currencies: financial stability implications”, Report No 4 by a group of central banks, September.

- Panetta, F. (2021) “A digital euro to meet the expectations of Europeans”, introductory remarks at the ECON Committee of the European Parliament, April.

- For example, users’ identity could be kept separate from payment data, with only financial intelligence units entitled to identify payers and payees when suspicious activity is detected.

- Panetta, F. (2021) ““Hic sunt leones” – open research questions on the international dimension of central bank digital currencies”, speech at the ECB-CEBRA conference on international aspects of digital currencies and fintech, October.

Eiropas Centrālā banka

Komunikācijas ģenerāldirektorāts

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Pārpublicējot obligāta avota norāde.

Kontaktinformācija plašsaziņas līdzekļu pārstāvjiem