What is ANFA?

Updated on 13 September 2024 (first published on 5 February 2016)

The Agreement on Net Financial Assets (ANFA) is an agreement between the national central banks (NCBs) of the euro area and the European Central Bank (ECB), which together form the Eurosystem. The agreement sets rules and limits for holdings of financial assets which are related to national tasks of the NCBs. Such financial assets of NCBs include, for example, the counterpart to their capital and accounting reserves or other specific liabilities, their foreign reserves and employee pension funds or assets held for general investment purposes.

Holding financial assets not relating to monetary policy is an integral part of the functions exercised by central banks in Europe, and precedes the euro. When the monetary union was founded, governments decided to mutualise only those central bank functions and tasks that are necessary to conduct a single monetary policy for the whole euro area. At the same time, they decided to keep NCBs as independent institutions that can continue to perform national tasks provided that these tasks do not interfere with the single monetary policy.

In other words: NCBs are financially independent institutions and carry out monetary policy tasks related to the Eurosystem’s primary role of maintaining price stability as well as national tasks. ANFA was established to set an overall limit to the total net amount of financial assets relating to national, non-monetary policy tasks, such that they would not interfere with monetary policy.

How does ANFA work?

Every central bank holds assets that are not related to monetary policy. In the euro area, monetary policy is set centrally by the Governing Council of the ECB for all member countries. When the Economic and Monetary Union was founded, governments set out in the European treaty that tasks related to monetary policy would be transferred to the European level. Beyond monetary policy, the NCBs would be – and are – allowed to conduct national tasks. This principle is laid down in Article 14.4 of the Statute of the ESCB and of the ECB.

In practice, the NCBs currently hold assets not related to monetary policy or the conduct of Eurosystem foreign exchange operations, such as:

- gold or foreign currency reserves;

- investment portfolios, e.g. for staff pension funds;

- assets held as counter positions to deposits from customers, e.g. domestic governments or foreign central banks.

At the same time, the NCBs also hold liabilities that are not related to monetary policy, including the abovementioned deposits from domestic governments, foreign central banks or from EU institutions. The NCBs can pursue these national tasks as long as their actions do not interfere with the objectives and tasks of the European System of Central Banks (ESCB), especially monetary policy. Likewise, the ECB holds an own funds portfolio related to its capital and accounting reserve, as well as a staff pension fund portfolio.

NCBs already held the abovementioned investment portfolios before joining the Eurosystem, the revenues of which contribute to the financial income of NCBs. When the euro area was set up, it was noted that these portfolios would contribute to satisfying the demand of the euro area banking system for liquidity, so they would be taken into account when calibrating monetary policy operations. From a monetary policy perspective, it was not considered a problem that such portfolios would continue to be managed by the NCBs, outside of monetary policy operations, and that they could be allowed to grow over time at the same (or at a slower) rate as the demand for banknotes and the reserve requirements of the banking system. The Governing Council also considered that, if non-monetary policy portfolios, net of non-monetary policy liabilities, were to grow faster than the demand for liquidity for an extended period of time, then this could put monetary policy at risk. ANFA was established to manage and cap this growth.

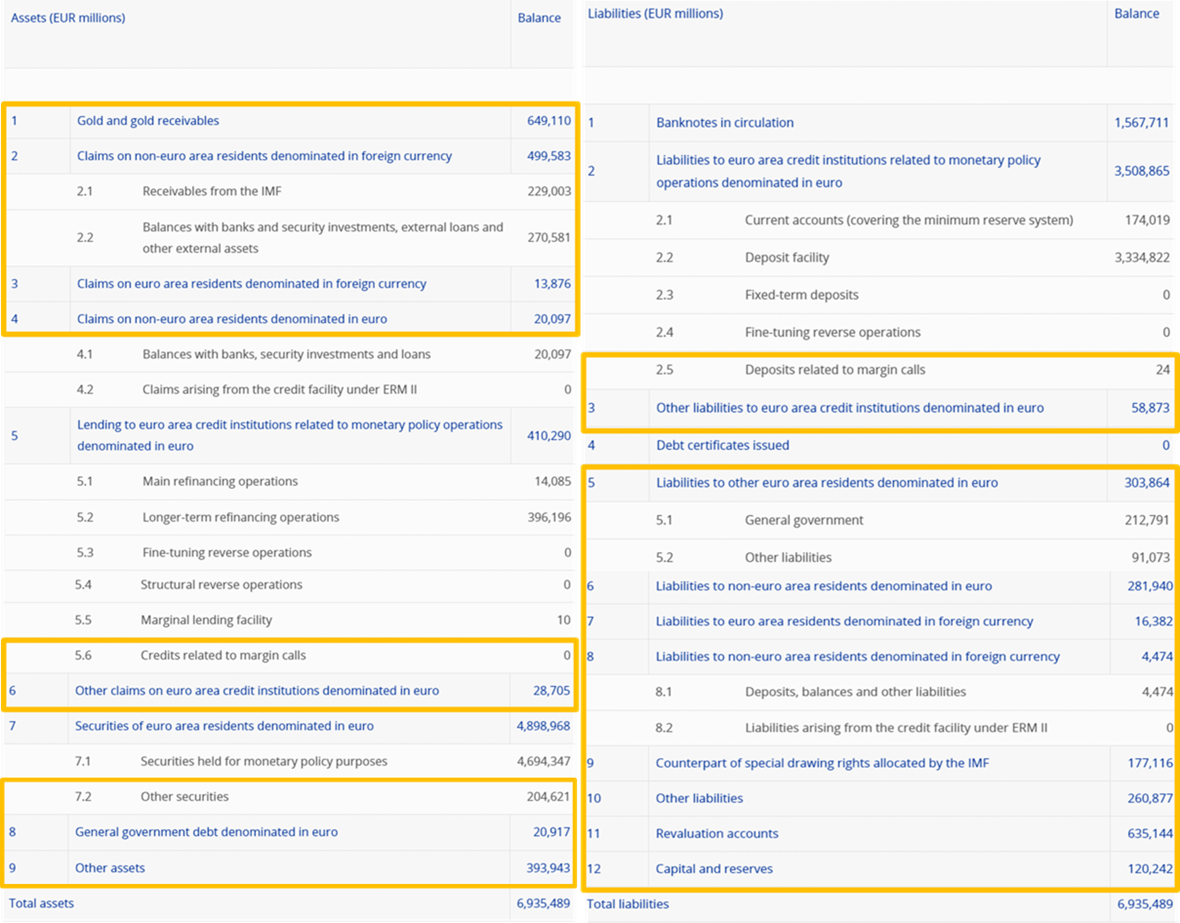

On the asset as well as on the liability side of a central bank’s balance sheet there are positions that are not directly related to monetary policy. The difference between the two sets of positions is defined as net financial assets or NFA. This concept is illustrated below, using the balance sheet of the Eurosystem’s weekly financial statement as of 29 December 2023, as published on the ECB's website. A precise definition is given in Annex I of ANFA.

The illustration shows that NFA include, on the asset side, the sum of balance sheet items 1 to 4, 5.6, 6, 7.2, 8 and 9. On the liability side they include items 2.5 and 3 to 12. If you subtract the sum of these liabilities from the sum of the aforementioned assets (i.e. the respective sections highlighted in gold below), you get the Eurosystem’s net financial assets.

As of 29 December 2023, the Eurosystem’s NFA stood at -€28 billion. In previous years, Eurosystem NFA had continuously declined, largely due to the increasing liability side of the balance sheet that more than offset relevant positive developments on the asset side, as explained above. This trend reversed in 2023, where Eurosystem NFA increased over the year, largely driven by a substantial decrease in the liability side of the balance sheet. This was primarily driven by a reduction in non-monetary policy deposits, with the Governing Council having adjusted the remuneration of such deposits on a number of occasions in recent years, including in September 2022 and February 2023.

Development of NFA versus banknotes and minimum reserve requirements (MRR) (in € billion)

ANFA limits the amount of NFA that national central banks can hold. This is necessary to ensure that the changes in liquidity associated with movements in NCBs’ NFA do not interfere with the effective implementation of monetary policy. Before the financial crisis of 2007-08, the most effective way to implement monetary policy was by making sure that banks had to ask for liquidity from the Eurosystem. A liquidity shortage vis-à-vis the Eurosystem, also referred to as a “liquidity deficit”, was the basis of monetary policy implementation. ANFA protected this liquidity deficit. When the financial crisis struck, it became necessary to provide banks with more liquidity than they actually needed to comply with minimum reserve requirements. Now, instead of operating with a liquidity deficit, the banking system is operating with excess liquidity. In this environment, ANFA ensures that excess liquidity does not surpass the level that the Governing Council sees as appropriate for its monetary policy stance.

No, the opposite is the case. ANFA sets a limit for the maximum amount of NFA an NCB can hold in order to ensure that changes in its financial assets and liabilities not related to monetary policy do not interfere with the Eurosystem’s monetary policy.

The growing total value of banknotes in circulation and the amount of minimum reserves that banks have to keep at the central bank create a need for liquidity that is satisfied by the Eurosystem’s monetary policy operations and the NFA of the NCBs. By setting the minimum volume for monetary policy operations, an upper limit is determined for the NCBs’ NFA as a residual.

Every asset on a central bank’s balance sheet creates central bank money or liquidity. Every liability on its balance sheet withdraws liquidity. Netting all non-monetary policy-related assets and liabilities gauges the overall liquidity provided by a central bank’s non-monetary policy operations. To efficiently implement monetary policy, the amount of liquidity provided by an NCB’s non-monetary policy operations has to be capped. Therefore, to control the impact on the liquidity position of NCBs’ operations, net rather than gross financial assets are limited.

Calibration of NFA entitlements takes place at least every three years, though ad hoc calibrations can be conducted at the request of any party to the agreement. For each calibration, the Governing Council sets the necessary monetary policy parameters to achieve the most effective implementation of its monetary policy. The Governing Council decides the Eurosystem’s liquidity level, sets the minimum reserve ratio and determines the size of the monetary policy outright portfolios. In addition, the Governing Council takes into account developments in the amount of banknotes in circulation. The maximum amount of aggregate Eurosystem NFA is a residual of the aforementioned factors.

Once the aggregate ceiling for NFA is set, it is distributed in line with each NCB’s share in the ECB’s capital, also taking into account each NCB’s historical starting position, to determine the NCBs’ NFA entitlements for the subsequent year, with this NFA entitlement being in place for up to three years. If an NCB does not plan to use its entitlement entirely, ANFA provides the option to temporarily reallocate the unused part to other NCBs that want to hold a higher NFA ceiling. The unused part will be redistributed by a central mechanism defined in ANFA. With this reallocation, the NFA ceilings of the NCBs are set. The NCBs’ NFA must remain below their ceilings on an annual average basis.

Waivers can influence the distribution of the maximum amount of NFA in the Eurosystem. But they do not increase the maximum amount of NFA holdings of Eurosystem NCBs.

Waivers define a minimum entitlement of NFA that each NCB can hold. In other words, each NCB has the right to hold a certain share of the maximum amount of Eurosystem NFA, based on that NCB’s share in the ECB’s capital, with the amount corresponding to the waiver being that NCB’s minimum entitlement (this may be higher than the amount calculated according to its share in the ECB’s capital). Of course, if some NCBs hold NFA corresponding to their waivers that exceed their capital shares, the amount of NFA the remaining NCBs are permitted to hold will be reduced such that the maximum amount of Eurosystem NFA is never exceeded.

There are three types of waivers:

- The historical waiver (as specified in Annex III of ANFA) ensures that the NCBs do not have to reduce their NFA below a level which is linked to their historical starting position.

- The asset-specific waiver protects certain asset holdings (defined in Annex IV of ANFA) that cannot be sold easily by the NCB due to contractual restrictions or other constraints.

- The dynamic waiver adjusts the historical waiver of small NCBs over time in proportion to the growth or decline of Eurosystem maximum NFA.

Only the largest of the three waivers applies for the respective NCB.

If some NCBs plan to hold less than their entitlements, while others wish to hold more, then the unused part is redistributed by a central mechanism defined in ANFA. This is done in the context of the periodic calibration of the NFA ceilings. The redistribution of unused leeway is temporary, and is recalculated during the subsequent calibration. The redistribution has no influence on the aggregate amount of maximum NFA held by all euro area NCBs, which is determined by the monetary policy decisions of the Governing Council.

This depends on institutional preferences. Some jurisdictions have specific legal constraints on the non-monetary policy investments carried out by NCBs; others have legal provisions requesting that NCBs take their shareholders’ interests into account once their monetary policy tasks are fulfilled. Furthermore, some NCBs have large client and/or government deposits on the liability side, which influence their non-monetary policy portfolio holdings.

There is also a historical reason: before the introduction of the euro in 1999, a number of European central banks held rather large foreign reserves in order to manage their exchange rates, in particular vis-à-vis the Deutsche Mark. This was a situation comparable to when EU Member States joined the euro area after 1999, where the NCBs also held fairly large foreign reserves to manage their exchange rate vis-à-vis the euro before joining the Eurosystem. The NCBs’ different starting positions explain the considerable differences in their balance sheet composition, which persisted, in some cases, for a number of years after their country joined the euro area.

If an NCB were to consistently exceed its ceiling for NFA, this could affect monetary policy implementation. For that reason, the ECB monitors whether the NCBs comply with ANFA on an annual basis. If necessary, as stated in Article 14.4 of the Statute of the ESCB and of the ECB, the Governing Council can prohibit, restrict or limit the operations carried out by the NCBs outside of monetary policy if they interfere with the objectives and tasks of the ESCB, including Eurosystem monetary policy. So far, there has never been an unjustified deviation from the NFA ceilings.

A deviation is justified if, for example, it is caused by international commitments to the IMF or by an NCB’s provision of emergency liquidity assistance (ELA) to its banking system (as ELA is part of NFA, as defined in ANFA). If this happens, the NCB has to reduce its NFA as soon as possible in order to comply with ANFA again. It has one year to do so if the breach is due to drawings by the IMF.

It is not a problem if NFA stay below the calculated maximum level. This has been the case in general, but became more pronounced since 2014.This means that the euro area-wide liquidity needs generated by banknotes in circulation are higher than the liquidity-providing effect generated by Eurosystem NFA. The liquidity needs are instead covered using monetary policy tools, regular Eurosystem refinancing operations, monetary policy outright purchases or structural reverse operations.

This has never happened and is very unlikely to happen. ANFA is a unanimous agreement between the NCBs and the ECB; and all parties have committed to complying with it. In addition, the risk that the overall amount of NFA is too large is further reduced by using conservative assumptions when determining the NFA ceilings. This means that even if NFA were larger than the maximum and, consequently, monetary policy operations were smaller than initially envisaged, the desired structural liquidity position would probably still exist. Monetary policy operations may thus be smaller than desirable for the effective implementation of monetary policy in such a case, but the situation in the short term would not be acute and the ECB would take corrective action. If remedial action is needed, the Governing Council has various tools at its disposal to ensure that monetary policy operations are of a sufficient size. For example, as regards the size of the refinancing operations, the Governing Council may use liquidity-absorbing operations or increase the minimum reserve requirements.

The periodic calibration of ANFA is based on conservative assumptions. The NFA ceilings thus contain sufficient buffers to deal with unforeseen developments. For example, when calibrating the ceilings, it is assumed that banknotes in circulation will remain at the average level observed during the third quarter of the current year.

ANFA was adopted to avoid NFA interfering with monetary policy. Should the amount of NFA nevertheless exceed the overall maximum, it could mean that monetary policy operations may become too small to allow for an effective implementation of monetary policy.

As well as the amount of NFA, their composition also matters. For example, if individual monetary policy transactions and non-monetary policy transactions offset each other (e.g. one is a purchase of a security and another is a sale of the same security), this can send conflicting signals about the Eurosystem’s monetary policy intentions or reduce the effectiveness of monetary policy. Another example is central bank transactions in foreign currencies, which can impact exchange rates or be misinterpreted as exchange rate interventions. To ensure that these events do not interfere with monetary policy, the ECB has adopted measures that complement ANFA, including the ECB Guideline on domestic asset and liability management operations by the national central banks (ECB/2019/7), and the ECB decision on a secondary markets public sector asset purchase programme (ECB/2015/10). While the former, for example, controls the net liquidity effects of NCBs’ operations, the latter limits, among other things, the amount of a specific security eligible for the public sector purchase programme held in all portfolios of the Eurosystem central banks.

As explained above, ANFA sets a maximum for the NCBs’ NFA. At the same time, this limits the liquidity effect from non-monetary policy transactions carried out by the NCBs. Second, in their non-monetary policy transactions, the NCBs and the ECB act as institutional investors. When NCBs make purchases for non-monetary policy portfolios, they follow similar criteria to other institutional investors and consider their decisions separately from monetary policy. They have to follow rules set out in ANFA and other relevant guidelines. The ECB is regularly informed about the NCBs’ (1) non-monetary policy transactions, some of which do require prior approval by the ECB; (2) their assets and liabilities; and (3) their expected and actual NFA. The ECB can take corrective action if the reported non-monetary policy transactions interfere with the monetary policy stance. Finally, the Governing Council can adopt specific measures that are binding for the NCBs.

NCBs’ non-monetary policy assets and liabilities are made public in compliance with national and European rules. Following these rules, the NCBs decide whether to publish information on their non-monetary policy assets and liabilities, including the composition of their non-monetary policy portfolios. Most NCBs disclose additional details in their annual reports or in other publications and on their websites, where they show, for example, a breakdown of their assets into government and non-government debt. Just like other investors, NCBs do not disclose information that could allow others to make inferences about their future investment behaviour.

The Eurosystem has no mandate to disclose the composition of non-monetary policy assets and liabilities of NCBs.

The ECB is responsible for monitoring that the central banks of the ESCB respect the prohibition of monetary financing, as stated in the Treaty on the Functioning of the European Union as well as in the Statute of the European System of Central Banks and of the ECB. This is not addressed by ANFA, which only concerns the desired structural liquidity position for implementing monetary policy and, as such, defines the size of the NFA. ANFA neither addresses the composition of non-monetary policy assets and liabilities nor the manner in which they are acquired.

To monitor compliance with the prohibition of monetary financing, the ESCB NCBs are required to inform the ECB about their assets and the ECB monitors that the NCBs do not finance governments by buying their debt in the primary market. The ECB also monitors purchases in the secondary market. The results of these checks and assessments are published in the ECB’s Annual Report.

This is not covered by ANFA but by Articles 123 and 124 of the Treaty on the Functioning of the European Union (i.e. by the highest ranking type of European law). The Governing Council of the ECB determined rules for all NCB investment operations to ensure that they do not contravene the monetary financing prohibition. Primary market purchases of government debt are forbidden and the NCBs have to report their transactions in the secondary market. The ECB monitors compliance with the monetary financing prohibition and reports on the results of its monitoring in its Annual Report.