- PRESS RELEASE

July 2022 euro area bank lending survey

19 July 2022

- Credit standards tightened for firms and households, with uncertainty remaining high and monetary policy becoming less accommodative

- Firms’ demand for loans continued to increase, driven by working capital needs

- Banks report deterioration in access to wholesale funding

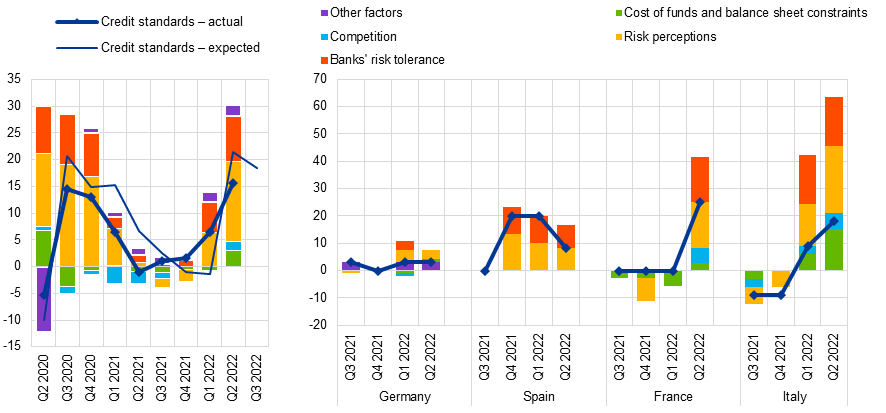

According to the July 2022 euro area bank lending survey (BLS), credit standards – i.e. banks’ internal guidelines or loan approval criteria – for loans or credit lines to enterprises tightened considerably further (net percentage of banks standing at 16%, see Chart 1) in the second quarter of 2022. Regarding loans to households for house purchase, euro area banks reported a strong net tightening of credit standards (net percentage of 24%), while credit standards for consumer credit and other lending to households tightened moderately (net percentage of 9%). In the context of high uncertainty, continuing supply chain disruptions and high energy and input prices, banks cite perceptions of increased risk and lower risk tolerance as factors behind the net tightening of credit standards for firms. As monetary policy is becoming less accommodative, euro area banks also reported that their cost of funds and balance sheet constraints had contributed to the tightening of credit standards for loans to firms and households. For the third quarter of 2022, they expect a net tightening of credit standards for loans to firms of a similar magnitude to that in the second quarter (18%). In addition, euro area banks expect credit standards to continue to tighten for both housing loans (24%) and consumer credit (13%).

Banks’ overall terms and conditions – i.e. the actual terms and conditions agreed in loan contracts –tightened for loans to firms and loans to households in the second quarter of 2022. For loans to firms, this was due mainly to a considerable widening of margins on riskier loans, while margins on average loans widened more moderately. Despite the net tightening of terms and conditions, margins on both loans for house purchase and consumer credit narrowed, partly reflecting the fact that market reference rates relevant for banks’ funding costs increased more than the interest rates on loans to households.

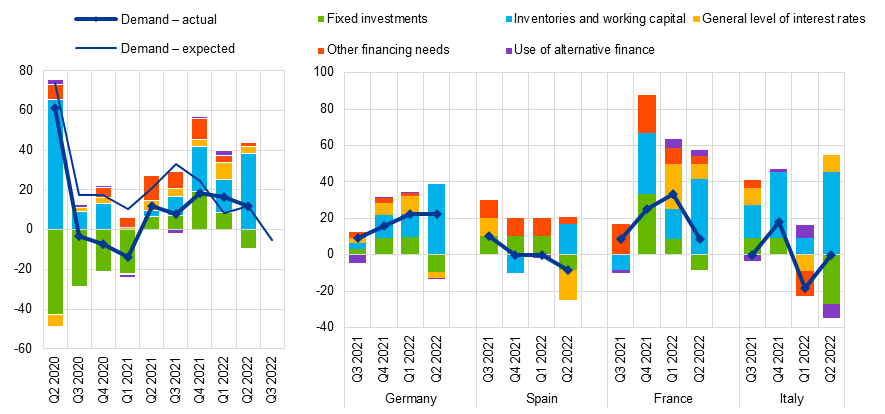

Banks reported, on balance, an increase in firms’ demand for loans or drawing of credit lines in the second quarter of 2022 (see Chart 2). Loan demand continued to be driven by firms’ financing needs for working capital, which is likely related to the higher prices for energy and raw materials in the context of ongoing supply chain disruptions. Fixed investment had a dampening impact on firms’ net demand for loans, indicating that they may be postponing investment in the current uncertain environment. In addition, the positive contribution of the general level of interest rates to loan demand was more moderate compared with the previous quarter. In the second quarter of 2022, net demand for housing loans fell after increasing in the first quarter, while demand for consumer credit and other lending to households continued to rise in net terms. The net decrease in demand for housing loans was due mainly to lower consumer confidence and the general level of interest rates, while the increase in demand for consumer credit was driven predominantly by spending on durables. For the third quarter of 2022, banks expect a net decrease in firms’ demand for loans, a strong net decrease in demand for housing loans and broadly unchanged demand for consumer credit.

According to the banks surveyed, access to money markets, securitisation and particularly debt securities deteriorated, in net terms, in the second quarter of 2022, reflecting the tightening of financial market conditions for banks. By contrast, access to retail funding improved slightly over the same period. In the first half of 2022, euro area banks’ non-performing loan ratios had a small net tightening impact on credit standards for loans to enterprises, but there was no reported impact on loans for house purchase and consumer credit or other lending. Across most of the main economic sectors, euro area banks indicated a more pronounced net tightening of credit standards for new loans to enterprises. They also reported a net increase in demand for loans or credit lines across all main economic sectors, in line with the reported overall increase in firms’ demand for loans in the first and second quarters of 2022.

The euro area bank lending survey, which is conducted four times a year, was developed by the Eurosystem in order to improve its understanding of bank lending behaviour in the euro area. The results reported in the July 2022 survey relate to changes observed in the second quarter of 2022 and expected changes in the third quarter of 2022, unless otherwise indicated. The July 2022 survey round was conducted between 10 and 28 June 2022. A total of 153 banks were surveyed in this round, with a response rate of 100%.

For media queries, please contact Silvia Margiocco, tel.: +49 69 1344 6619.

Notes

- A report on this survey round is available on the ECB’s website. A copy of the questionnaire, a glossary of BLS terms and a BLS user guide with information on the BLS series keys can be found on the same webpage.

- The euro area and national data series are available on the ECB’s website via the Statistical Data Warehouse. National results, as published by the respective national central banks, can be obtained via the ECB’s website.

- For more detailed information on the bank lending survey, see Köhler-Ulbrich, P., Hempell, H. and Scopel, S., “The euro area bank lending survey”, Occasional Paper Series, No 179, ECB, 2016.

Chart 1

Changes in credit standards for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards, and contributing factors)

Source: ECB (BLS).

Notes: Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. The net percentages for “other factors” refer to further factors which were mentioned by banks as having contributed to changes in credit standards.

Chart 2

Changes in demand for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Source: ECB (BLS).

Notes: Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts