1 Preface

This is the third edition of the European Central Bank’s biennial report on financial integration and structure in the euro area (FISEA). As explained in greater detail when the first edition was released in March 2020,[1] it is designed to focus on structural developments in the financial system of the euro area and, in some cases, of the European Union (EU), as well as on related policy issues. In so doing, it covers developments in financial integration across member countries, changes in financial structure (the mixture of financial markets and intermediaries) and financial development or modernisation (for example through innovations in the financial system). Definitions of these three concepts and how they link to Eurosystem tasks and functions were provided in more detail in the 2020 preface.

The findings of this report concern issues relevant for the policy discussion related to the European banking union, the European capital markets union and thus the financial aspects of deepening Economic and Monetary Union.

The report has two main sections.

The first section reviews changes to the environment and the context in which the euro area economy financial landscape is evolving. It also identifies policy priorities in the light of ongoing policy debates.

The second section provides analytical material, with a focus on the main trends in financial integration, structure and development, based on a review of the standard set of ECB indicators of financial integration and structure. The indicators and their descriptions are included in an online Statistical Annex (SA).[2]

The report also includes boxes that examine the following eight topics in greater depth.

- Massive investment is needed to meet EU green and digital transition targets

- The derivatives clearing landscape in the euro area three years after Brexit

- Reassessing euro area financial integration: the role of financial centres

- Home bias and repo rates

- Intra-euro area cross-border bank lending: a boost to banking market integration?

- Do EU SURE and Next Generation EU (NGEU) bonds contribute to financial integration?

- Examining the causes and consequences of the recent listing gap between the United States and Europe

- Rapid growth and strategic location: Analysing the rise of FinTechs in the EU

The cut-off date for data used in this edition of the report was 17 May 2024.

2 Executive summary

Over the last two years, the euro area has been confronted with significant global geopolitical and economic shocks that have profoundly affected the landscape in which investment and financial decisions are made.

Against this background, advancing the integration of the financial markets of the European Union (EU) and implementing the open strategic autonomy agenda at the EU level are vital steps for strengthening and securing economic and financial resilience.

The asset size of the euro area financial sector has contracted in absolute nominal terms since 2022, despite a rise in GDP over the period. This is mainly the result of valuation effects and monetary policy tightening. In relative terms, the respective weights of banks and non-banks in the overall euro area financial sector have remained roughly unchanged, while the Eurosystem balance sheet has declined.

Meanwhile, the contribution of non-bank financial intermediaries to financing activities has broadly stabilised recently, after a decade of marked increases. In the course of 2022, rising interest rates triggered a decline in the valuations of equity and debt securities portfolio holdings. The subsequent rebound was broadly based across investment funds, insurance companies and pension funds.

Since 2022, financing flows have more generally reflected changing economic and financial conditions. With debt financing experiencing a decline, the euro area economy’s financing mix has shifted towards equity. This can be attributed to weakened borrowing from banks due to higher lending rates, tighter credit standards and an uncertain growth outlook. Attractive valuations are also likely to have boosted equity investment.

Despite the resilience demonstrated during crises, progress on financial integration in the euro area has been disappointing overall. Both price-based and quantity-based financial integration indicators have declined substantially over the past two years, with no sizeable increase since the inception of Economic and Monetary Union. Despite significant legislative efforts over the last decade, cross-border financial market activities and risk sharing have not grown, and it appears that a piecemeal approach has been taken towards many of the reform efforts.

In particular, there has been only limited progress on banking market integration since the inception of banking union. Clearer regulatory frameworks are required for group-wide risk management to facilitate and support the free flow of liquidity and capital across borders.

The integration of the euro area internal market for financial services remains crucial, and even more so in the face of the growing financing challenges posed by the green, digital and defence transitions.

Policy actions should now focus on developing a strategy and creating an environment for mobilising savings and funding. Incentives for making additional funding capacities available could be provided through the following three lines of action that have the potential to be mutually reinforcing:

- “unfreezing” a share of the unproductive deposits held by euro area households;

- developing bond and equity markets to make them more attractive for issuers and investors;

- enhancing the attractiveness of euro area financial markets for foreign investors.

Meanwhile, progress in the following six policy domains is crucial for bolstering the integration of Europe’s financial markets and fully realising their potential:

- removing barriers to cross-border crisis management and facilitating cross-border banking;

- harmonising the definition of key concepts in EU regulatory frameworks;

- integrating the EU capital market regulatory and supervisory architecture;

- reviving securitisation for the capital markets union;

- increasing standardisation and transparency in the field of structured products;

- promoting vibrant EU risk capital and equity markets.

Capital markets integration is crucial for facilitating the investments needed for the green, digital and defence transitions, as well as for bolstering the EU’s productivity and competitiveness in the face of challenging geopolitical dynamics. To help achieve this aim, the EU should develop a clear strategy to build a more vibrant, dynamic, competitive and environmentally sustainable economic environment.

3 Policy priorities in a new environment

3.1 Key objectives within a new environment

Since 2022, the euro area economy has faced global geopolitical and economic developments significantly affecting its investment needs. Investment activities in the euro area economy have been influenced by the economic recovery from the COVID-19 pandemic, government stimulus measures and global economic trends shaped by geopolitical developments. An unprecedented series of negative supply shocks caused by pandemic-induced supply chain disruptions, Russia’s unjustifiable invasion of Ukraine and the ensuing energy crisis have significantly increased input costs for all sectors of the economy.

Advancing the integration of EU financial markets and implementing an open strategic autonomy agenda at the European Union (EU) level will contribute to economic and investment resilience in the face of these new and evolving global geopolitical and economic challenges.

3.1.1 Financing needs in an evolving geopolitical environment

A new era in geopolitical affairs is emerging, possibly leading to global fragmentation and a multipolar reorganisation of international relations with significant implications for trade, financial structures and integration worldwide. Following several decades of financial openness, multilateralism and globalisation, the global economy is increasingly challenged by geopolitical tensions and rivalry between some major countries. This has led to a rise in subsidies and/or restrictions to trade, especially in critical inputs, a reorientation of global value chains, measures to ensure energy security, and strategic autonomy policies aimed, for example, at restricting foreign direct investment (FDI) in strategic assets. Most recently, the EU and others have imposed trade, financial and technology transfer sanctions in response to Russia’s war of aggression against Ukraine. These policies often entail trade-offs between economic security on the one hand and the availability and efficient allocation of resources, including capital, on the other. As a result, the risks of fragmentation in global trade and finance have increased.[3]

The EU and its Member States are faced at this point with very high additional financing needs. The green and digital transitions, compounded by energy and external security concerns, will require major investment expenditures (see Box 1).

The green transition may benefit from supplementary measures to enhance access to and the adoption of sustainable finance. Such measures include financing and non-financial support, accompanied by regulatory measures and collaborative efforts. Financing support encompasses direct financing, leveraging private sector involvement and facilitating participation in green capital markets. Regulatory measures should be aimed at simplifying voluntary reporting standards and promoting interoperability among reporting standards. Non-financial support – in the form of technical assistance and the provision of data and information, for instance – together with collaborative efforts focused on knowledge sharing and policy dialogue would further help to assist companies’ transition to sustainable finance practices.

Finally, defence expenditures are also expected to rise because of the evolving geopolitical environment. According to European Central Bank (ECB) simulations, were EU Member States to increase their defence spending to 2% of GDP annually (as per the NATO commitment), this would imply an estimated additional total of more than €400 billion in constant prices for the euro area member countries compared with the level observed before the start of Russia’s war in Ukraine.[4]

Box 1

Massive investment needs to meet EU green and digital targets

Substantial green and digital investments will be needed in the coming years to reach the targets set for 2030 and beyond under the Green Deal and the Digital Compass.[5] Reaching these targets[6] would help the EU to reduce its greenhouse gas (GHG) emissions, boost potential growth, improve competitiveness, address strategic vulnerabilities and promote economic security and resilience at the EU level. However, the EU faces a large gap in funding for these investment needs which needs to be seen in the context of limited fiscal space, raising the question of how private capital can be best mobilised to bridge the gap. This box presents an overview of estimates of green and digital investment needs and discusses some of the challenges to be met, in particular in terms of funding needs.

More3.1.2 A new inflation and interest rate environment

From late 2020, euro area headline inflation, as measured by the Harmonised Index of Consumer Prices (HICP), climbed steadily, rising above the ECB’s 2% target in July 2021.[7] It peaked at 10.6% in October 2022 after increasing throughout 2021 and most of 2022 (Chart 1). It then fell steadily to reach an estimated 2.4% in April 2024. The original rise mainly reflected a surge in energy and food prices, triggered by Russia’s war in Ukraine. Past supply bottlenecks and pent-up demand from the coronavirus (COVID-19) pandemic, together with high input costs in production due to the rise in energy prices, ramped up price pressures across many sectors of the economy. From December 2022, the reversal in energy prices accounted for more than half of the drop in headline inflation. All major components of inflation saw gradual declines in year-on-year inflation rates over the second half of 2023, reflecting the fading impact of previous cost shocks and weaker demand due to tighter monetary policy.

With inflationary pressures rising throughout the economy, the ECB took decisive action in 2022 to prevent longer-term inflation expectations from becoming unanchored above its 2% target. From July 2022 to September 2023 the ECB increased its key policy rates in ten steps by a cumulative 450 basis points (Chart 1).

Short-term euro area rates were influenced by the tightening of monetary policy decisions and resulting expectations. The ten-year overnight index swap (OIS) rate increased from slightly above 0% in January 2022 to 3% in October 2022. It then hovered around 3% for most of 2023, peaking at 3.3% in October 2023, before declining to 2.5% in December 2023. The decline in the ten-year OIS rate reflected lower financial market interest rate expectations, primarily driven by lower-than-expected inflation.

Heightened uncertainty about inflation and the reaction of monetary authorities led to a worldwide increase in risk-free long-term yields. The euro area ten-year GDP-weighted average of government bond yields closely followed developments in the short-term risk-free rate. The euro area GDP-weighted average of ten-year nominal government bond yields stood at 2.82% in December 2022 and 2.72% in December 2023, 269 and 259 basis points higher respectively than at the end of 2021.

Long-term euro area country rates closely followed developments in short-term rates, albeit with some variations. Despite some differences, movements in sovereign spreads were contained overall, in part owing to the Governing Council’s announcement in June 2022 that it would apply flexibility in reinvesting redemptions falling due in the pandemic emergency purchase programme (PEPP) portfolio and the announcement in July 2022 of the Transmission Protection Instrument (TPI).

Chart 1

Euro area headline inflation and ECB key policy rate

(percentages; monthly data, Jan. 1999-Apr. 2024)

Sources: Eurostat and ECB.

Funding costs for euro area banks increased steeply in response to the monetary policy tightening measures. Increasing short and long-term risk-free interest rates affected the overall funding environment for banks. Changes in the terms and conditions of the ECB targeted longer-term refinancing operations (TLTRO III) also contributed to higher bank funding costs. Finally, the gradual increase in the remuneration of customer deposits further elevated funding costs for banks, although increases in bank lending rates were higher overall in the euro area.

Bank lending rates for both firms and households saw significant increases from 2022, and credit standards tightened. The composite bank lending rate for loans to households for house purchases rose steeply, reaching its highest level in almost 15 years by the end of 2023. Lending rates for non-financial corporations increased substantially, rising by almost twice as much as those for households.

The increases in lending rates were rapid and large, reflecting the faster and more significant policy rate hikes implemented by the ECB from July 2022. Despite these increases, the transmission of monetary policy changes to lending rates across euro area countries remained smooth, albeit with disparities in lending rates for both households and corporates.

3.1.3 A much-needed resilience framework for the EU

The EU has developed an open strategic autonomy agenda to address rising geopolitical risks while maintaining economic openness and enhancing resilience. Measures in the financial sphere such as FDI screening aim to balance openness, efficiency and security. Nevertheless, such measures may entail trade-offs. The extent of the trade-offs depends on the full set of domestic policies adopted to ensure, for example, the more efficient functioning of domestic capital markets. In addition, the cost-benefit calculations for open strategic autonomy policies may differ depending on the time horizon considered. For example, strategic autonomy measures to defend against cybersecurity threats may entail costs in the short term but result in accumulated benefits in the longer run, including from a financial stability perspective. All in all, carefully targeted measures need to be taken in response to geopolitical tensions and with a view to ensuring strategic autonomy. These measures also need to be accompanied by EU policies that can also offset adverse effects arising from financial tensions.[8]

The EU’s financial system must bolster financing through deeper and better functioning banking and capital markets. With the establishment of the banking union, a key step has already been taken towards increasing the stability of the euro area financial system.[9] Completing the banking union and making progress on the capital markets union will enhance market stability, depth and breadth. It will also reduce reliance on foreign players[10] and mitigate the possible effects of materialising geopolitical risks on the availability and efficient use of capital.

Payments and financial market infrastructures need to function autonomously enough to prevent geopolitical risks or a misalignment of interests from creating financial stability risks.[11] Greater reliance on domestic financial infrastructures may increase resilience,[12] while continuing to ensure competition and innovation remains crucial. Against this background, Box 2 assesses the EU’s progress in reducing its dependence on UK clearing services and building more resilient EU clearing markets.

Safe assets play a vital role in financial resilience and stability.[13] The wider availability of safe assets, including at EU level, would facilitate monetary policy transmission, support EU public goods financing, and foster financial stability and integration (see also Box 6). Initiatives such as Next Generation EU (NGEU) and green bonds provide support in this regard, promoting long-term investments aligned with EU objectives.[14] Together with institutional enhancements, the improved EU financial landscape would be likely to attract more international investors, including during times of geopolitical stress.[15]

A resilient international role for the euro bolsters the euro area’s economic and financial autonomy while preserving openness. Central banks holding euro reserves create ties not only between international partners but also between potential geopolitical adversaries. This may reduce geopolitical tensions. However, challenges such as sanctions[16] and digital currency competition exist, highlighting the need for sound policies and sufficient availability of safe assets to strengthen the euro’s international standing.[17]

Box 2

The derivatives clearing landscape in the euro area three years after Brexit

The United Kingdom’s decision to leave the EU impacted the EU’s financial infrastructure, in particular those financial market segments heavily reliant on UK firms operating outside the EU as a result of Brexit.[18] A high degree of reliance on non-EU services is not in keeping with the goals of the Capital Markets Union (CMU), which aims to foster the development of deep and liquid capital markets in the EU, advance financial integration within the euro area, and preserve financial stability.

More3.2 Policy priorities

Progress on advancing financial integration in the euro area over the last decade has been disappointing. Although many important pieces of legislation have been passed, there has been no significant increase in cross-border financial market activities and risk sharing. In addition, a piecemeal approach appears to have been taken towards many of the reform efforts.

Despite the limited progress to date, the integration of the euro area internal market for financial services remains essential. This is especially the case in view of the growing financing challenges resulting from the green, digital and defence transitions. Capital markets integration is crucial for facilitating the investments needed for the green, digital and defence transitions and for bolstering the EU’s productivity and competitiveness in the face of challenging geopolitical dynamics. In addition, efforts to achieve a fully integrated financial services market should be accompanied by additional reforms to improve the conceptual framework of some regulations.

Progress in the six policy domains set out in this section is crucial for furthering the integration of Europe’s financial markets and fully realising their potential.

3.2.1 Removing barriers to cross-border crisis management and facilitating cross-border banking

During the upcoming European legislative term, efforts should be made to tackle remaining barriers to cross-border crisis management and to complete the banking union’s institutional architecture.

Impediments to group-wide risk management within cross-border banking groups are hampering financial integration through the banking sector. The incoming European Commission should make it a priority to complete the banking union. In particular, establishing a European Deposit Insurance Scheme (EDIS) could support authorities in providing added flexibility for group-wide risk management and enhance overall reassurance. As part of this wider work to complete the banking union, banking groups operating across borders should be granted the same risk management opportunities as those operating within a single Member State. The institutions of the banking union, the ECB and the Single Resolution Board should be entrusted with greater powers to (i) set appropriate requirements for capital, eligible loss-absorbing liabilities and liquidity at the level of each subsidiary in a banking group, and (ii) use recovery and resolution plans to make sure that losses can be properly distributed across groups and that liquidity can flow where needed in times of stress. Pending the establishment of a fully fledged EDIS, rules governing the transfer of Deposit Guarantee Scheme contributions should be reviewed to align such contributions with transferred risks when credit institutions change affiliations within the EU, ensuring that financial stability is preserved across the system.

3.2.2 Harmonising the definition of key concepts in EU regulatory frameworks

The rise of new financial business models calls for further EU regulatory harmonisation, beginning with definitions of key concepts. Harmonising these concepts is essential to prevent fragmentation and potential stability risks.

Differences in the transposition of the Markets in Financial Instruments Directive (MiFID)[19] across EU Member States has resulted in inconsistent definitions of “financial instruments”. In addition, the enactment of the Markets in Crypto-Assets Regulation (MiCAR)[20] has resulted in additional regulatory uncertainties regarding the “financial instruments” category.[21] Differing definitions increase compliance costs for issuers and hinder cross-border financing. Uncertainty in defining certain concepts such as “deposits” and “extending credit” exacerbates regulatory ambiguity, leading to market fragmentation and difficulty in identifying stability risks.

Establishing a uniform regulatory regime for agents and distributors across the EU is vital for integration and stability. The absence of EU-wide rules for regulating non-regulated or lightly regulated entities distributing financial products also creates an uneven playing field and the potential for arbitrage.

3.2.3 Integrating the EU capital markets regulatory and supervisory architecture

A single rulebook for EU capital markets legislation would enhance integration. A single rulebook would, among other things, address remaining barriers in securities post-trade services such as those concerning collateral management. Harmonisation in related areas such as insolvency laws, securities law, accounting and corporate taxation would facilitate integration, offering clarity to cross-border investors.

Integrated supervision of EU capital markets would harmonise practices, preventing market fragmentation and enhancing scale and depth.[22] While the European Supervisory Authorities (ESAs) promote supervisory convergence, further harmonisation is needed for transparency and predictability.

Improving the governance of ESAs, particularly the European Securities and Markets Authority (ESMA) and the European Insurance and Occupational Pensions Authority (EIOPA), would help ensure better European outcomes. Adequate resources and oversight powers are crucial for effective action. The possibility of ESAs supervising the most systemic cross-border market actors in cooperation with national supervisors should be assessed with a view to furthering EU capital market integration.

3.2.4 Reviving securitisation for the capital markets union

Securitisation should effectively transfer risks from banks to a broader investor base, freeing up bank capital and fostering additional real economy financing and transition related lending. A mix of policy measures targeting both supply and demand are crucial for developing securitisation markets in a prudent and sustainable way. This includes reviewing the prudential treatment of securitisation for banks and insurance companies while accounting for international standards and assessing potential amendments to disclosure and due diligence requirements.

Pan-EU issuances – potentially backed by a public guarantee – can broaden investor bases and support targeted segments such as green securitisation. It is not so much differences in the regulatory framework as the role that US government-sponsored enterprises play in supporting the standardisation and depth of the US securitisation market that explains the difference with the European market.[23],[24] A European platform for green securitisation could act as a catalyst by playing the role of issuer and standard-setting agent. Progress in harmonising insolvency regimes, corporate law and taxation law would be the most effective way of creating harmonised pools of assets that would scale up securitisation and help to achieve of a single market for capital more generally.

3.2.5 Increased standardisation and transparency in the field of structured products

Increased standardisation and transparency are also needed in the field of structured products, climate-related disclosures could be improved through work on a number of regulatory areas. Asset-backed securities and covered bonds represent a large share of the collateral mobilised by counterparties to Eurosystem refinancing operations, yet information is lacking to properly assess their climate change-related risks. Regulatory disclosures could close this information gap. First, regarding covered bonds, the European Commission has invited the European Banking Authority (EBA) in a call for advice[25] to investigate the role of green covered bonds and to assess the need to introduce disclosure requirements regarding the environmental, social and governance risks of cover pools of covered bonds. A revision of the Covered Bond Directive (CBD)[26] could introduce new disclosure requirements that would provide the Eurosystem and other investors with the information needed to properly assess climate-related risks. Second, with regard to green securitisation, the EU Green Bond Standard Regulation (EU GBS)[27] provides a welcome standard for securitisations based on the alignment with the EU taxonomy of the use of proceeds by the originator of the securitised assets. However, a revision of the securitisation templates by ESMA would be needed to require additional climate-related disclosures for non-green securitisation (such as information on energy performance for real estate assets), which would allow the climate-related risks of the underlying assets to be properly assessed.

3.2.6 Promoting vibrant EU risk capital and equity markets

Vibrant, pan-EU capital markets are vital for securing funding for investments and bolstering the EU’s productivity and competitiveness. Risk capital markets are particularly critical for fostering the innovation necessary for the green and digital transition and enabling companies to access the funding needed for investing and growing.

One approach to enhancing the appeal of listing in the EU could involve harmonising listing requirements. To date, EU policy has been aimed at reducing regulatory costs, especially for smaller companies, so as to alleviate administrative burdens. Extending these efforts to larger companies would promote the expansion of EU capital markets, encouraging these companies to list within the EU rather than elsewhere (see also Box 7). Fragmentation within the EU stock exchange landscape poses a challenge, as larger and more efficient markets tend to attract greater initial public offering (IPO) activity and liquidity. Therefore, further consolidation of EU stock exchanges and measures to cultivate large EU-based institutional investors, such as asset managers and pension funds, could enhance the attractiveness of listing in the EU.

Additionally, implementing tax incentives to reduce the debt-equity bias for corporations and encourage retail investor participation in equity markets could further deepen EU public equity markets. More efficient and harmonised insolvency laws and regulatory frameworks for equity investments could also help improve certainty for investors, reducing costs and facilitating cross-border investments, while at the same time making risk capital more attractive and accessible to companies.[28]

4 Analytical contributions

4.1 Developments in the financial system structure

The euro area financial sector has shrunk in absolute nominal terms since 2022. Despite a rise in nominal GDP, the total financial assets of the euro area financial sector have declined across sectors, mainly because of valuation effects (Chart 2, panel a and Statistical Annex (SA) – Chart 1 – ST25)[29]. The Eurosystem recorded the largest decline as the central bank gradually reduced its balance sheet from 2022 as part of the monetary policy normalisation. All segments of the non-bank financial intermediaries sub-sector saw a decline in financial assets (relative to nominal GDP), except for money market funds (MMFs).

At the same time, the composition of the euro area financial sector has remained broadly unchanged. The share of banking sector assets in total financial system assets (including Eurosystem assets) has stabilised at around one-third.[30] Meanwhile, after growing continuously from December 2011 to December 2019, the share of non-bank financial intermediary (NBFI) assets decreased up until September 2021.[31] The subsequent gradual increase in the NBFI footprint since late 2021 comes against the background of a declining Eurosystem balance sheet and broadly stable credit institution assets (Chart 2, panel b).

Chart 2

Size and composition of the euro area financial sector

a) Total assets of the euro area financial sector | b) Share of euro area financial sub-sectors in total financial sector assets |

|---|---|

(left-hand scale: € trillions; right-hand scale: ratio; quarterly data, Q1 1999-Q4 2023) | (left-hand scale: percentages, right-hand scale: ratio; quarterly data, Q1 1999-Q4 2023) |

|  |

Source: ECB.

Note: Non-bank financial institutions include investment funds, insurance companies and pension funds, money market funds and other financial intermediaries.

4.1.1 Banking sector

Banking sector total assets stabilised at around one-third of financial system (including central bank) total assets. This was driven mainly by the normalisation of monetary policy and valuation effects.

Euro area banks’ profitability surged owing to increased net interest margins. This resulted in their highest profits since the inception of the Single Supervisory Mechanism, with significant institutions achieving a 10% year-to-date return on equity in the third quarter of 2023, up from 7.6% the previous year. Less significant institutions also improved significantly compared with the previous year. However, worsening asset quality and higher funding costs pose headwinds to profitability.[32]

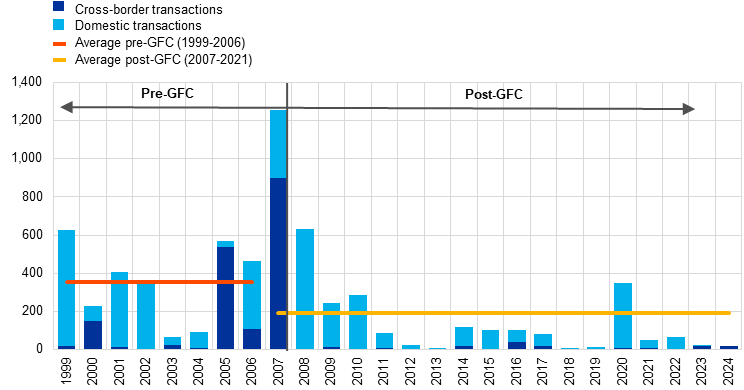

Despite the favourable profitability, banking sector consolidation has seen limited progress since the banking union’s inception. The declines in the number of credit institutions in the euro area (SA – Chart 15 – ST38) and in mergers and acquisitions (M&A) activity have slowed in recent years (Chart 3). Various factors are hindering bank mergers, including divergent tax regimes and national legislation on competition, credit and customer protection. Harmonisation efforts are crucial and should extend beyond banking regulations to encompass key concepts in banking and financial services. Regulatory uncertainty is impeding business development, fostering market fragmentation within Member States’ borders. New financial business models are further complicating matters. Progress on removing regulatory barriers to cross-border risk management as part of wider work to complete the banking union is essential, necessitating clear frameworks for group-wide risk management and the free flow of liquidity and capital across borders.[33]

Chart 3

Total assets of target banks in the euro area

(€ billions)

Sources: ECB and ECB calculations.

Notes: The sample includes M&A transactions involving significant institutions and less significant institutions in the euro area, excluding some private transactions and transactions among small banks not reported in Dealogic. Transactions associated with the resolution of banks and distressed mergers were removed from the sample. Transactions are reported based on the year in which they were announced. GFC stands for global financial crisis.

4.1.2 Non-banking sector

Total assets of the euro area non-bank financial sector increased to €52 trillion in 2023, reversing a decline in 2022. This development was driven by growth in the total assets of investment funds, insurance companies and pension funds following declines in the value of these sectors’ equity and debt securities portfolio holdings in 2022 as interest rates increased (Chart 4, panel a). As a result, the size of these sectors increased relative to that of other financial institutions (OFIs, i.e. financial auxiliaries, captive financial institutions and money lenders, financial vehicle corporations and other OFIs) in 2023 (Chart 4, panel b). Similarly, there was a marginal increase in non-banks’ share of total financial sector assets between 2022 and 2023.

Chart 4

Total assets of the euro area non-bank financial sector

a) In absolute terms by sector | b) In relative terms by sector |

|---|---|

(left-hand scale: € trillions; right-hand scale: percentages, end-of-year observations, 2016-23) | (left-hand scale: percentages; right-hand scale: percentages, end-of-year observations, 2016-23) |

|  |

Sources: ECB (QSA, BSI, IVF, PFBR, ICB) and ECB calculations.

Note: ESCB stands for European System of Central Banks.

Money market and investment funds

Money market funds’ (MMFs’) total assets stood at €1.7 trillion in the fourth quarter of 2023, an increase of 24% from the first quarter of 2022. MMF assets remained highly concentrated in Ireland, Luxembourg and France. Following the increase in euro area interest rates between July 2022 and September 2023, MMFs experienced strong inflows as their returns increased.

The investment fund (IF) sector has experienced a sharp decline followed by a strong rebound in total assets since the first quarter of 2022. IF sector assets are concentrated in Luxembourg, Ireland, Germany and France (SA – Chart 41 – ST23). Total assets of the sector had declined to €16 trillion by December 2022, driven by declines in the value of equity and debt securities holdings as interest rates increased (Chart 5, panel a), as well as significant outflows from bond and equity funds (SA – Chart 38 – ST29).[34] Subsequently, total assets of the sector increased to €17.1 trillion in December 2023. This reversal was supported in particular by positive inflows for equity and bond funds and rising equity valuations during 2023.

The composition of the IF sector continues to evolve, with the share of equity funds in total sector assets rising relative to the mixed and bond fund segments. Equity, bond and mixed funds collectively accounted for 76% of IF sector assets in December 2023 (Chart 5, panel b). The share of equity funds initially declined in 2022 before growing to 32% in December 2023. Part of this rise can be attributed to strong growth in passive investment via exchange-traded funds (ETFs). ETFs’ total assets increased from €1.4 trillion to €1.7 trillion between March 2022 and December 2023 (SA – Chart 39 – ST30). Similarly, the share of other funds in the IF sector has also increased in recent years, reaching 14% at the end of 2023. This appears to be partly driven by growth in private equity and credit funds.[35] Private equity funds provide an alternative source of financing for the real economy by funding typically riskier companies that may otherwise be unable to access bank lending, public debt or equity markets.[36]

While growth in the IF sector can contribute to financial integration, a large share of inflows to the sector are invested outside the euro area. Investment funds facilitate cross-border financing and risk sharing. However, a large share of IF sector assets continue to be invested outside the euro area, which has not helped fund domestic companies (Chart 5, panel c). While investors in euro area investment funds thus benefit from diversified portfolios and investment opportunities in foreign economies, this could also point to less intra-euro area equity market integration due to less developed capital markets.

Chart 5

Developments in the euro area investment fund sector

a) Investment funds’ total assets by asset type | b) Share of investment fund sector total assets held by fund type | c) Investment funds’ debt securities and equity holdings, by region |

|---|---|---|

(€ trillions; quarterly data, Q1 2009-Q4 2023) | (percentages; quarterly data, Q1 2009-Q4 2023) | (left-hand scale: percentages; right-hand scale: € trillions; quarterly data, Q1 2009-Q4 2023) |

|  |  |

Source: ECB (IVF).

Notes: Panel c: outstanding value of investment funds' holdings of euro area and non-euro area debt securities and equity (excluding investment fund shares). EA = euro area.

Insurance companies and pension funds

Insurance companies and pension funds (ICPFs) have experienced a decline in total assets since 2022. Total assets of the sector fell from €12.1 trillion in the first quarter of 2022 to €11.4 trillion in the third quarter of 2023 (Chart 6, panel a). This decline was mainly driven by falling valuations of longer-dated debt securities due to interest rate increases, together with falls in the value of investment fund shares.[37]

More generally, ICPFs assets remain concentrated in relatively few euro area countries, where they tend to focus on offering their services domestically. Over 70% of the sector’s assets relate to insurance companies (SA – Chart 31 – ST33). Insurance companies’ assets are concentrated in France, Germany and Italy, while the Netherlands accounts for most of the euro area pension fund sector (SA – Chart 32 – ST34). As well as focusing on providing their services domestically, ICPFs also typically invest in euro area assets, thereby helping to fund domestic companies (Chart 6, panel b).

Chart 6

Insurance companies’ and pension funds’ balance sheet developments

a) ICPFs’ total assets by asset type | b) ICPFs’ debt securities and equity holdings, by region |

|---|---|

(€ trillions; end-of-year observations, 2009-23) | (left-hand scale: percentages, right-hand scale: € trillions; quarterly data Q1 2017-Q4 2023) |

|  |

Source: ECB (ICB, PFBR).

Note: Panel b: outstanding value of investment funds’ holdings of euro area and non-euro area debt securities and equity (excluding investment fund shares, where holdings are also primarily focused on the euro area).

4.1.3 Role of non-bank financial intermediaries

The role of NBFIs in financing the real economy has become more important over the past decade, despite a decline in their share of total credit granted since 2022. NBFIs accounted for 27% of outstanding credit to non-financial corporations as of the third quarter of 2023, down from 30% at the end of 2021 (Chart 7). This decline was mainly driven by falling market valuations of corporate debt securities held by non-banks in 2022.

Chart 7

Share of non-bank credit to non-financial corporations

(percentage of total credit granted by financial institutions; quarterly data, Q1 1999-Q4 2023)

Sources: ECB (SHSS/CSDB; Box 2 entitled “Measuring market-based and non-bank financing of non-financial corporations in the euro area” Financial Integration and Structure in the Euro Area, ECB, Frankfurt am Main, April 2022.

Leaving aside the broadly stable lending and increased debt securities exposure among banks, the scale of interconnectedness between banks and non-banks has remained largely unchanged since 2022. As of the third quarter of 2023, cross-exposures between monetary financial institutions (MFIs) and non-banks mainly related to asset exposures to OFIs, including exposures via loans to OFIs (around €1.1 trillion) (Chart 8, panel a) and debt securities issued by OFIs (approximately €1 trillion) (Chart 8, panel b). Aside from OFIs, the most significant link to the non-bank sector are MFIs’ holdings of IF shares. As for NBFIs, IFs hold exposures to banks via loans, while OFIs hold exposures to banks via debt securities issued by banks.

Interconnectedness among different non-banks derived predominantly from non-banks holding IF shares, and cross-exposures among non-banks remained relatively stable from the first quarter of 2022. Collectively, ICPFs, IFs and OFIs held €6.3 trillion in IF shares as of the third quarter of 2023, down from €6.7 trillion in the first quarter of 2022. Most of the decline relates to revaluations of IF shares held by ICPFs (Chart 8, panel b). Holdings of debt securities issued by OFIs represent the next largest cross-exposure among non-banks, with aggregate ICPF, IF and OFI holdings of such securities increasing by €0.1 trillion to €1.4 trillion in the period from the first quarter of 2022 to the third quarter of 2023.

Chart 8

Trends in cross-exposures among sectors of the euro area financial system, by instrument type and holder sector

a) Exposures via non-marketable securities | b) Exposures via marketable securities |

|---|---|

(€ trillions; Q1 2022 and Q3 2023) | (€ trillions; Q1 2022 and Q3 2023) |

|  |

Sources: ECB (EEA, BSI) and ECB calculations.

Notes: The data include intragroup positions. OFIs are specifically non-monetary financial corporations, including financial vehicle corporations and excluding non-MMF IFs.

4.2 Financial integration developments

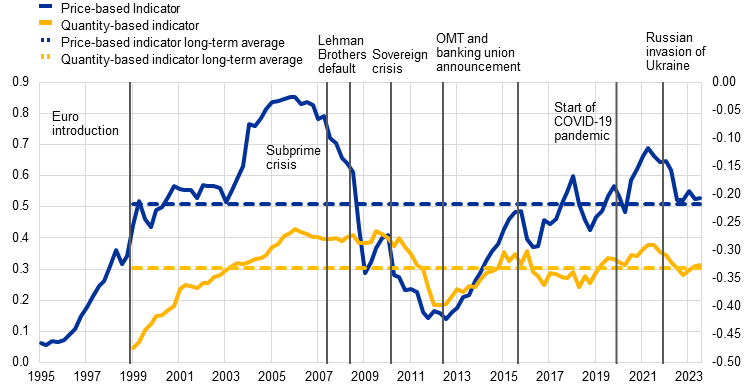

4.2.1 Developments in price-based and quantity-based financial integration indicators

The evolution of financial integration in the euro area has remained disappointing, despite the resilience shown during crises. Financial integration as measured by both the price-based and the quantity-based financial integration composite indicators has declined substantially over the last two years (Chart 9). For the price-based indicator this has been driven by sizeable drops in both the equity market and banking market sub-indices (SA – Chart 1 – S1-S4).

In addition, financial integration in the euro area has not increased in either price-based or quantity-based terms since the start of Economic and Monetary Union (EMU). Since the second quarter of 2023, both indicators have stabilised around their respective long-term average value. Box 3 sheds further light on the actual state of euro area financial integration by highlighting that traditional measures of financial integration are inflated by large cross-border assets and liabilities in euro area financial centres.

Chart 9

Price-based and quantity-based financial integration composite indicators

(quarterly data; price-based indicator: Q1 1995-Q4 2023; quantity-based indicator: Q1 1999-Q3 2023)

Sources: ECB and ECB calculations.

Notes: The price-based composite indicator aggregates ten indicators for money, bond, equity and retail banking markets; the quantity-based composite indicator aggregates five indicators for the same market segments except retail banking. The indicators are bounded between zero (full fragmentation) and one (full integration). Increases in the indicators signal greater financial integration. From January 2018 onwards the behaviour of the price-based indicator may have changed due to the transition from EONIA to €STR interest rates in the money market component. OMT stands for Outright Monetary Transactions. For a detailed description of the indicators and their input data, see the Statistical Web Annex to this report and Hoffmann, P., Kremer, M. and Zaharia, S., “Financial integration in Europe through the lens of composite indicators”, Working Paper Series, No 2319, ECB, Frankfurt am Main, September 2019.

Box 3

Reassessing euro area financial integration: the role of euro area financial centres

This box reassesses the patterns of euro area financial integration, adjusting for the role of financial centres in the euro area. Since the introduction of the euro, Luxembourg, Ireland and the Netherlands have accumulated large volumes of cross-border assets and liabilities, vis-à-vis both intra- and extra-euro area counterparts. In fact, as shown in Chart A, the exceptional growth in euro area cross-border financial positions since 1990 has been driven largely by positions vis-à-vis Luxembourg, Ireland and the Netherlands which are referred to as “euro area financial centres” (EAFCs).[38] Their special role involves acting as one of the euro area’s major hubs for (i) the investment fund industry, and (ii) securities issuance by affiliates of foreign companies. For example, investment funds domiciled in Luxembourg and Ireland hold around 40% of the euro area’s cross-border equity and debt securities, while 33% of all intra-euro area cross-border holdings of corporate bonds are in securities issued in EAFC jurisdictions.

More4.2.2 Money market

Money market integration has improved thanks to the increase in money market activity as excess liquidity is withdrawn. Interbank money market activity used to be largely confined to national borders (see also Chart 13 in Section 4.2.3), with cross-border transactions representing only a third of the total, and conducted predominantly by big banks. However, the weight of cross-border transactions started to increase with TLTRO III repayments. Banks mainly resorted to three funding sources to substitute their large maturing TLTRO III funds: (i) excess liquidity holdings, (ii) reserves redistributed via the money markets across borders, and (iii) bank bond issuances.[39]

After the repayments of the TLTROs, interbank reserve redistribution mainly took the form of repo transactions. The euro money market, dominated by secured segments, recorded a volume of repo trades four times larger than that for unsecured trades (Chart 10, panel a). Repo rate developments have become essential for assessing the level of integration in short-term financing markets. An analysis of bilateral repo trades reveals that total daily cross-border activity in Italy, Spain, Germany and France was higher in every quarter of 2023 compared with 2022 (Chart 11). While Italy, Spain and France have consistently been net importers of liquidity in bilateral repos, Germany has been a net exporter in bilateral repos since the second quarter of 2023.[40]

Collateral availability improvements led to convergence in secured rates across euro area jurisdictions. Government bond scarcity affected repo rates, with German government bonds in high demand in 2022 (Chart 10, panel b). However, collateral availability subsequently improved thanks to strong sovereign net debt issuance, TLTRO III repayments that facilitated the release of securities pledged as collateral with the Eurosystem and the reduction in the Eurosystem’s asset holdings. The improved collateral availability reduced rate dispersion in 2023 and aligned repo rates more closely with the ECB deposit facility rate. Box 4 further investigates whether lenders penalise borrowers for pledging domestic collateral.

Chart 10

Euro money market turnover and overnight repo rates by collateral issuer jurisdiction

a) Daily transaction volume in unsecured and secured segments | b) Difference between the repo rate and the deposit facility rate |

|---|---|

(EUR € trillions; quarterly data, Q3 -2016-Q4 2023) | (basis points; monthly data, Jan. 2020 – -Jan. 2024) |

|  |

Sources: ECB (MMSR) and ECB calculations.

Notes: Panel a: the money market statistical reporting (MMSR) dataset is based on transaction-by-transaction data from a sample of the 50 largest euro area reporting agents. Panel b: end-of-quarter dates excluded. The rates include both general collateral (GC) and non-GC trades aggregated.

Chart 11

Bilateral repo flows in the big four countries

Imports, exports and net flows

(€ billions; quarterly data, Q1 2022-Q4 2024)

Notes: The figures represent the average of the daily import, export and net flows of liquidity via bilateral repos of all maturities against all collateral on a quarterly basis. Liquidity imports have been calculated as the sum of borrowing of domestic reporting agents (RAs) from foreign counterparties and lending of foreign RAs to domestic non-RA counterparties. Liquidity exports are the sum of lending of domestic RAs to foreign counterparties and the borrowing of foreign RAs from domestic non-RA counterparties. Net flows are imports minus exports. End-of-quarter dates excluded. The rates include both general collateral (GC) and non-GC trades aggregated. For confidentiality reasons, the export data point for Italy in the third quarter of 2023 and the import data point for Spain in the fourth quarter of 2023 are not shown.

On the unsecured market, rate dispersion persisted. Activity in the unsecured interbank market remained limited in size and largely concentrated in Germany. Banks benefiting from rating upgrades could trade at more competitive prices in money markets, leading to price convergence in the upper range of unsecured borrowing. At the same time, dispersion in the lower range of unsecured borrowing rate distribution increased, reflecting transactions between depositors without access to the central bank balance sheet (e.g. NBFIs) and banks with high credit ratings.[41] The continued rate dispersion driven by NBFIs has not disrupted the pass-through of changes in the key ECB interest rates to unsecured money market rates. However, it explains the asymmetry that emerged in 2023 in the reaction of the spread between the €STR and the ECB’s deposit facility rate, which has been less responsive to the reduction of excess liquidity compared with the earlier increase of liquidity.

Bank bond issuance also contributed to cross-border liquidity redistribution. An analysis of TARGET balance levels and the gross bank bond issuance volumes per country between mid-2022 and the end of 2023 suggests that investors from core countries absorbed bank bond issuances to benefit from the better returns offered (Chart 12, panel a).

TARGET data reflected increased cross-border flows. Since 20 March 2023,[42] TARGET has comprised the new wholesale payment system T2,[43] which contributes to cross-border payment integration by enabling banks to centralise their euro-denominated payments including money market transactions in central bank money. Between April 2023 and February 2024, the share of cross-border payments in T2 showed a slightly more pronounced increase in value terms than in volume terms (Chart 12, panel b).

Chart 12

Bank bond absorption flows per jurisdiction and cross-border activity in T2

a) TARGET balance net outflows and inflows versus gross bank bond issuance | b) Share of cross-border activity in T2 |

|---|---|

(Jun. 2022-Dec. 2023; € billions) | (percentages of total payments (values and volumes); monthly data, Apr. 2023-Feb. 2024) |

|  |

Sources: Dealogic, ECB eligible assets databaseand Eurosystem balance sheet data, T2 data and ECB calculations

Notes: Panels a) and b): bond issuance includes covered and senior unsecured bond issuance of euro area banks since mid-June 2022. TARGET balance net inflows and outflows are measured as the difference between the average A9.4 and L10.3 balances on the eighth maintenance period of 2023 and on the fourth maintenance period of 2022. Panel c): cross-border activity is defined as a payment made between institutions holding accounts at different central banks in the RTGS service of T2. Central bank payments, liquidity transfers and technical transactions are excluded. Data for euro-denominated cross-border transactions are aggregated on a monthly basis.

Box 4

Home bias and repo rates

It is well documented that European banks’ securities portfolios consist largely of domestic securities, which is referred to as the “home bias”. Less attention, however, has been paid to the fact that the composition of a bank’s securities portfolio could affect its activities in the money market. Since the 2008-09 financial crisis, the unsecured segment of this market has gradually lost importance as a broad-based funding avenue, leading to a market dominated by repurchase agreements (repos), in which participants borrow cash and use securities as collateral.[44] Given the home bias in their securities portfolios, European banks often borrow in repo markets, pledging domestic government bonds as collateral (Chart A).[45]

More4.2.3 Loan market

Banks are the largest suppliers of loans to the euro area economy. They provided around 45% of the stock of loans outstanding as at the end of 2023 (SA – Chart 5 – ST51). Non-financial corporations and other financial intermediaries each provided 16% of the stock of loans outstanding – often in the form of inter-company loans.

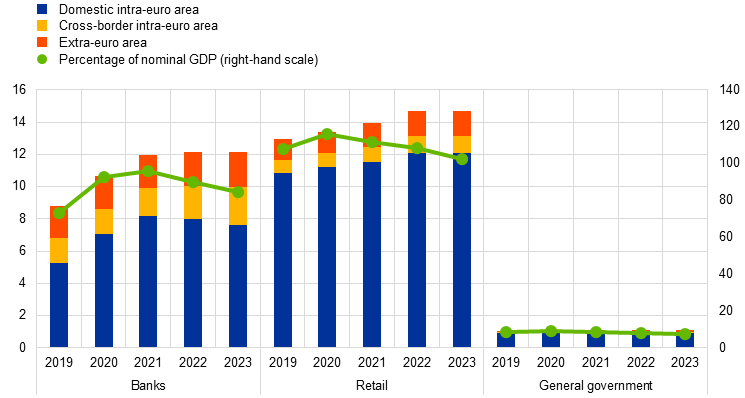

Both retail and interbank loans have increased in nominal terms since 2021, although they have declined relative to nominal GDP (Chart 13). Interbank lending stabilised at around €12 trillion from 2021, while both intra-euro area and extra-euro area cross-border interbank lending rose. Retail bank lending grew by €0.8 trillion from €13.9 trillion at the end of 2021. By the end of 2023, extra-euro area and intra-euro area loans as a share of total retail bank loans had increased by 0.2 percentage points each to 10.5% and 7.4%, respectively.

Outstanding bank loans to governments have hovered around €1.1 trillion for the past decade, playing a relatively minor role as governments primarily rely on debt securities issuances for financing.[46] Notably, (cross-border) extra-euro area bank loans to governments account for a larger share than (cross-border) intra-euro area loans (around 9.9% versus 3.5% in 2023).

Chart 13

Stock of bank loans in the euro area by counterparty type and domicile

(left-hand scale: € trillions; right-hand scale: percentages; end-of-year data, 2019-23)

Source: ECB.

Loan market integration has increased in quantitative terms owing to increased interbank lending, a less resilient form of banking market integration.[47] Aggregate intra-euro area cross-border lending across counterparty sectors reached a record high in 2022. At the same time, direct cross-border retail bank lending within the euro area remained limited, while cross-border interbank lending picked up from the end of 2021 (Chart 14, panel a). Box 5 highlights the importance of cross-border bank lending within the euro area, focusing on the growth of direct cross-border lending as a driver of banking market integration, while also discussing the implications of different lending approaches.

Disparities in bank interest rates for new loans to non-financial corporations and households have remained limited from a historical perspective despite rate fluctuations. This points to a smooth transmission of monetary policy changes to lending rates across euro area countries (SA – Chart 27 – S36, SA – Chart 28 – S37 and Section 3.1.2). Meanwhile, the sub-index for the banking market, reflecting rate differences in both new loans and deposits (Chart 14, panel b), has significantly decreased since mid-2021, partly due to increased disparity in household deposits (SA – Chart 25 – S34).

Chart 14

Euro area banking market integration in quality and price terms

a) Intra-euro area foreign retail bank lending relative to intra-euro area foreign interbank lending | b) Price-based sub-index for banking market |

(left-hand scale: € trillions; right-hand scale: ratio; quarterly data, Q1 2008-Q4 2023) | (monthly data, Jan. 1995-Feb. 2024) |

|  |

Sources: ECB and ECB calculations.

Notes:

a) The blue line shows the total amount of intra-euro area cross-border bank lending to households and non-financial corporations, i.e. retail bank lending. The yellow line shows the total amount of intra-euro area cross-border lending between MFIs, i.e. interbank lending. The orange line shows the ratio between the two. For more discussion on the interpretation of these indicators, see Special Feature A entitled “Financial integration and risk sharing in a monetary union” Financial integration in Europe, ECB, Frankfurt am Main, April 2016.

b) The indicators aggregated into the sub-index are the cross-country dispersions of interest rates on new loans to households (for consumer credit and total loans) and non-financial corporations, and the cross-country dispersions of deposit rates for households and non-financial corporations on deposits with agreed maturity. Data for Greece are included.

Box 5

Intra-euro area cross-border bank lending: a boost to banking market integration?

Cross-border bank lending to non-banks is an important element of banking market integration within Economic and Monetary Union (EMU).[48] Cross-border bank lending may follow a direct or an indirect model. With direct lending, a lender based in euro area country A lends money to a borrower domiciled in euro area country B. In an indirect model, a banking group headquartered in euro area country A lends money – via a branch or a subsidiary located in euro area country B – to a borrower residing in euro area country B. Using credit register data available at the ECB, this box sheds light on the relevance of cross-border bank lending in the euro area.[49]

More4.2.4 Bond market

Market expectations drove the rise in average sovereign yields from February 2022, before the ECB started to actually raise policy rates in July of that year. As soon as market expectations that central banks were approaching the peak of the rate hiking cycle consolidated, bond yields stabilised, as did yield spreads. The existence of ECB government bond purchase programmes such as the public sector purchase programme (PSPP) and the public sector portion of the PEPP, along with the rapid announcement of anti-fragmentation instruments such as PEPP flexibility (June 2022) and TPI (July 2022), helped to keep yield dispersion contained, thereby preserving the functioning of the monetary policy transmission mechanism.

Price-based measures of bond market integration have recovered since 2022. After a significant fall in the first half of 2022, the price-based sub-index for bond markets has recovered since July 2022, although it remains below its 2021 level (Chart 15, panel b). The cross-country dispersion of government bond yields has remained relatively well contained despite the rapid increase in average yields that has taken place since 2022 (see SA – Chart 11 – S18). Although some sovereign spreads widened in the first half of 2022 – notably in Italy and Greece – this spread widening was more contained in terms of magnitude and duration than during episodes such as the 2009-14 sovereign debt crisis. Government bond market integration has increased since 2020, reaching levels close to historical hight (see SA – Chart 12 – S20). While the integration indicator (Chart 15, panel b) remains below its 2021 peak, this may reflect divergences in macro and fiscal fundamentals across euro area countries rather than undue market fragmentation.

Chart 15

Euro area bond market integration in quality and price terms

a) Intra-euro area foreign long-term debt investments relative to intra-euro area foreign short-term debt investments | b) Price-based sub-index for the bond market |

(left-hand scale: € trillions; right-hand scale: ratio; quarterly data, Q1 2008-Q4 2023) | (monthly data, Jan. 1995-Mar. 2024) |

|  |

Sources: ECB and ECB calculations.

Notes:

a) The indicators aggregated into the sub-index are the cross-country standard deviations of two-year and ten-year sovereign bond yields (Greece excluded), and the cross-country standard deviation of the bond yields of uncovered corporate bonds issued by non-financial corporations (data are aggregated at country level).

b) The figures cover not only debt securities liabilities, but also other instruments such as currency deposits and loans (F2 and F4), trade advances and account payables (F81 and F89), insurance, and pensions (F6) and FDI debt instruments (FL). As a convention, F6 and FL are classified entirely as long-term liabilities.

In contrast to price-based measures of bond market integration, quantity-based measures do not show any significant improvement in integration since the last report. Intra-euro area cross-border long-term debt securities holdings have stabilised while short-term holdings have decreased since mid-2022. This is due to a flattening in yield curves driven by central bank rate hikes and lower growth expectations (Chart 15, panel a). Cross-border holdings of debt securities, which are at the core of integration, have reflected broad relative stability since 2017 (Chart 16, panel a). The share of cross-border euro area MFI and fund holdings of government and corporate debt securities (see SA – Chart 14 – S22 and SA – Chart 15 – S23) has remained broadly stable. In addition, there has only been a small recovery – back to 2020 levels – in the share of cross-border euro area MFI holdings of other MFI securities (SA – Chart 19 – S28).

A noticeable development since 2022 has been the marked increase in households’ holdings of domestic government debt in a number of countries. This has contributed to a decline in the share of cross-border holdings of government debt. The increase has been particularly visible in countries such as Italy where there have been large issuance programmes specifically targeting domestic retail investors but also in countries such as Spain and Germany that do not have such programmes, but where the low remuneration of bank deposits has made channelling savings to government debt particularly attractive to households (Chart 16, panel b). This investor base diversification is one element mentioned in Box 6, which analyses the contribution of EU SURE and NGEU bonds to financial integration.

Chart 16

Holdings of euro area debt securities

a) Stocks of debt securities in the euro area by domicile of financing provider | b) Euro area household sector holdings of government securities |

|---|---|

(left-hand scale: € trillions; right-hand scale: percentages; end-of-year data, 2017-23) | (percentages; quarterly data, Q1 2014-Q4 2023) |

|  |

Sources: ECB (SHS) and ECB calculations.

Box 6

Do EU SURE and NGEU bonds contribute to financial integration?

Over the period 2024-26, the European Commission will become the largest net issuer of euro-denominated securities with the issuance of bonds under the temporary Support to mitigate Unemployment Risks in an Emergency (SURE) and Next Generation EU (NGEU) programmes. To counter the negative economic and social consequences of the COVID-19 pandemic in Europe, the EU Council adopted two programmes to issue common EU bonds. The first was SURE, an EU programme to finance short-term employment schemes, with a view to helping Member States cope with sudden increases in public expenditure to preserve employment. This was followed by NGEU, which aimed at putting Member States on a path towards a sustainable recovery and a greener, more digital and more resilient Europe. In total, the European Commission had issued around €100 billion of SURE bonds by the end of 2022, when the programme ended, while the total issuance of NGEU bonds will amount to €806.9 billion over the period 2021-26, with €306 billion having already been issued by the end of 2023. This will render the Commission the largest net issuer of euro-denominated securities and result in the largest supranational stock of EU bonds in the history of the EU, akin to that of a medium-sized euro area sovereign.[50] In addition, EU bond issuance will increase the Aaa-rated segment of euro area government and supranational bonds by almost 40% (Chart A, panel a).

More4.2.5 Equity market

Equity market integration has decreased since 2018 against the background of a general increase in stock prices. Over this period, the price-based sub-index for equity markets (see SA – Chart 1 – S3) has been on a declining trend, bottoming out in December 2022, although still showing that the degree of overall equity market integration remains at the lower end of its historical measurement range. The initial surge in equity price return dispersion from the post-pandemic lows was broadly reversed as of August 2022, both at sector and country level (Chart 17 and SA – Chart 10 – S15).

Chart 17

Equity price return dispersion

a) At euro area sector level | b) At euro area country level |

|---|---|

(percentages; weekly data; 17 Sep. 2010-17 May 2024) | |

|  |

Sources: Bloomberg and ECB calculations.

Notes: Cut-off: 12 April 2024. The panels of this chart use two metrics to offer a high-level perspective on the euro area (price) return dispersion of the equity market at sector and country level. The first is the 30-week moving average of the weekly standard deviation of sector/country (price) returns – at sector level, the weekly standard deviation of (price) returns is calculated using the individual (price) returns recorded by the 20 sectors represented in the Euro Stoxx index. The second is the 30-week moving average of the weekly range of (price) returns at sector/country level – the weekly range of (price) returns is calculated as the (price) return difference between the second-best performer and second-worst performer in each week (separately, at sector and country level).

Cross-border holdings of equities, another core integration metric, have displayed broad relative stability since 2017. This stability holds true for listed equity securities affected by valuation effects (Chart 18, panel a), but also for a broader measure of marketable and non-marketable equity instruments (Chart 18, panel b).

The quality of euro area equity integration has broadly returned to its pre-crisis level but indicates a declining trend. Following a significant drop in the course of 2020, the ratio of intra-euro area cross-border holdings of equities to intra-euro area cross-border holdings of debt instruments has now nearly recovered to the pre-pandemic level (Chart 19, panel a). Intra-euro area FDI as a share of cross-border direct investment and portfolio equity investment has increased sharply since mid-2022, reaching pre-pandemic levels by mid-2022 before declining again (Chart 19, panel b).

Chart 18

Euro area equity holdings

a) Stocks of listed shares in the euro area by domicile of financing provider | b) Holdings (including investment fund shares and other equity holdings) by geographical issuer counterparty |

|---|---|

(left-hand scale: € trillions; right-hand scale: percentages; end-of-year data, 2017 to 2023) | (percentages of total euro area holdings of equities, quarterly data, Q1 2008-Q4 2023) |

|  |

Source: ECB.

Note: Panel b: Equity holdings include listed and unlisted shares, investment fund shares (of any type of investment fund) and other equities including, among other things, participations in international organisations (e.g. the ECB or the European Stability Mechanism) and holdings of real estate outside the domestic economy.

Chart 19

Indicators of equity market integration resilience in the euro area

(left-hand scale: € trillions; right-hand scale: ratio; quarterly data, Q1 2008-Q4 2023)

a) Intra-euro area foreign equity investments relative to intra-euro area foreign debt investments | b) Intra-euro area foreign direct investment |

|  |

Sources: ECB and ECB calculations.

Notes:

a) Both portfolio and direct investment holdings are included under equity holdings. For debt securities, only portfolio investment is included, since debt securities are not available for FDI (only total “debt instruments”). Even restricting the analysis to portfolio investment only, we still see the rising importance of equities in intra-euro area cross-border holdings. Looking at the sector contribution, we see a general increase in equity holdings for all sectors except money market funds (S123).

b) Intra-euro area FDI is calculated as the average of asset and liability positions to account for possible asymmetries. For portfolio investment, only the asset side is used since liabilities are not reported owing to the custodial bias.

4.2.6 Trends in risk sharing

Improving risk sharing across national borders is an essential driver for advancing financial integration in the euro area. The concept of risk sharing generally refers to the notion that economic agents, such as households and firms, attempt to insure their consumption streams against fluctuations in the business cycle of their country.

Risk sharing has been slightly improving while remaining at comparatively low levels. While the coefficient of correlation between euro area consumption and output had shifted upward in 2019/2020 (SA – Chart 4 – S7) – suggesting that a change in output and income tends to translate directly into a change in consumption and hence indicating a low degree of consumption risk sharing – this measure of risk sharing across euro area member countries has been fairly stable in recent years. Other recent estimates of risk sharing highlight an improvement attributed to the savings-credit channel.[51] As the euro area remains a predominantly bank-based financial system, and in the absence of risk sharing through capital markets, the absolute level of risk sharing in the EU remains lower than in the United States.[52]

4.3 Avenues for broader funding bases

4.3.1 Financing requirements

The ample internal sources of finance and elevated levels of retained earnings available to euro area non-financial corporations helped them to achieve strong growth in investment from 2022. While government investment also grew, household investment remained stable.

Fluctuations in external financing of non-financial corporations from 2022 reflected changing economic and financial conditions, as well as firm-specific factors. External financing of non-financial corporations grew throughout 2022, driven by strong borrowing from banks and robust inter-company lending, as well as increased trade credit flows and net issuance of shares (Chart 20). External financing of non-financial corporations then declined sharply during 2023, as borrowing from banks weakened owing to higher bank lending rates, tighter credit standards and an uncertain growth outlook. The net issuance of debt securities declined, as did trade credits, amid reduced inventory growth and imports. The net issuance of (specifically non-listed) shares remained strong, driven by M&A activity. Box 8 examines EU FinTech companies’ choices of location and assesses their funding mix. It finds that one of the reasons for the clustering of FinTechs close to financial centres is that being present in these locations may make it easier for them to access to equity finance.

After surpassing pre-pandemic levels in 2022, household financing flows decreased strongly in 2023. As banks tightened credit conditions, new lending to households weakened markedly after summer 2022 (Chart 20).

The fluctuations in government budgetary positions from 2022 onwards reflected economic conditions and policy decisions. In 2022 there was a significant improvement in the euro area deficit-to-GDP ratio (compared with 2021) which was largely driven by reductions in the general government expenditure-to-GDP ratio. In 2023 the euro area deficit-to GDP ratio improved only marginally, with the drop in the general government expenditure-to-GDP ratio roughly balancing the drop in the general government revenue-to-GDP ratio. Government investment spending as a percentage of GDP rose in 2023, which was also linked to the NGEU scheme.

Financing decisions translated into a higher share of equity in the euro area economy’s financing mix. The overall weight of debt instruments – debt securities, loans and trade financing – in the euro area financing mix decreased from 2022 (Chart 21, panel a). Meanwhile, the breakdown of financial corporation debt securities by instrument shows a slight preference for asset-backed securities over covered bonds. The breakdown also shows that the relative shares of non-mortgage backed securities (around 6%) and mortgage backed securities (around 5%) in the stock of debt securities issued by financial institutions (mainly banks) remained broadly stable (Chart 21, panel b).

Chart 20

External financing flows of euro area non-financial corporations, households and general governments by instrument

(flows; four-quarter sums; € billions, Q4 for 2019-23)

Sources: ECB (euro area accounts) and ECB calculations.

Notes: MFIs stands for monetary financial institutions. Non-MFIs include other financial institutions (OFIs) as well as insurance corporations and pension funds (ICPFs). “Other” is the difference between the total and the instruments included in the figure and includes inter-company loans and the rebalancing between non-financial and financial accounts data. Figures shown represent the sum of flows over the last four quarters at the end of the fourth quarter for 2019-22 and at the end of the third quarter for 2023. NFC stands for non-financial corporation, HH stands for household, and GG stands for general government.

Chart 21

External financing of euro area economy (stocks)

a) Stock of euro area economy external financing outstanding | b) Stock of debt securities issued by financial institutions by type of instrument |

|---|---|

(ratio to nominal GDP, Q4 for 2019-22; Q3 for 2023) | (EUR € trillions, annual data; 2017-23) |

|  |

Source: ECB.

Box 7

Examining the causes and consequences of the recent listing gap between the United States and Europe

Recent high-profile delistings from European stock exchanges and a gap in the number of listings in Europe compared with the United States have prompted concerns about the attractiveness of European equity markets.[53],[54] The role of listed shares issued by large non-financial corporations is fundamental in bolstering the depth and liquidity of public equity markets. However, unlike their counterparts in countries such as the United States, EU firms predominantly rely more on non-listed equity financing than listed shares.[55] Expanding the presence of listed equity is crucial for the growth of EU capital markets for a number of reasons, including its greater liquidity and its accessibility to a wider array of retail investors.[56] Moreover, listed equity can play a significant role in supporting the decarbonisation of economies.[57] One of the priorities of the 2020 CMU action plan for making financing more accessible to EU companies was to support access to public markets.[58] Against this backdrop, this box aims to shed more light on the gap in listings between the United States and Europe, and examines the reasons behind the delisting activities of EU companies. Additionally, it takes stock of dual and direct listings of EU companies in the United States to gauge the relative attractiveness of European and US markets for EU companies.

More4.3.2 Mobilising funding and increasing demand

There are three lines of action that have the potential to be mutually reinforcing and through which the large existing (unproductive) savings in Europe could be unlocked or mobilised for financing the euro area financial economy: (i) “unfreezing” a share of unproductive deposits held by euro area households, (ii) developing bond and equity markets to make them more attractive for issuers and investors to tap into, and (iii) enhancing the attractiveness of euro area financial markets for foreign investors.

Mobilising household deposits

Euro area households keep the predominant part of their savings in the form of deposits. Since the start of EMU, euro area households have on average kept one-third of their financial assets in the form of currency and deposits. In relative terms, the share of currency and deposits in household financial assets reached its highest point in autumn 2022, when euro area inflation peaked (Chart 22, panel a). Since 1999, households’ pension entitlements have also grown in relative size, rising from 8% to 12% of financial assets.