Published as part of the ECB Economic Bulletin, Issue 4/2025.

This box describes the Eurosystem liquidity conditions and monetary policy operations in the first and second reserve maintenance periods of 2025. Together, these two maintenance periods ran from 5 February to 22 April 2025 (the “review period”).

Average excess liquidity in the euro area banking system continued to decline. Liquidity provision decreased, owing to lower Eurosystem holdings under the asset purchase programme (APP) and pandemic emergency purchasing programme (PEPP) following the discontinuation of APP reinvestments at the beginning of July 2023 and PEPP reinvestments at the end of December 2024. The decline in liquidity provision also reflects the maturing of the last operation under the third series of targeted longer-term refinancing operations (TLTRO III) on 18 December 2024, because this operation continued to have an impact on the average figures for the previous review period. The decrease was partly offset by the continuing reduction in liquidity absorption through net autonomous factors.

Liquidity needs

The average daily liquidity needs of the banking system, defined as the sum of net autonomous factors and reserve requirements, decreased by €69 billion to €1,354 billion over the review period. This reflected the fact that liquidity-absorbing autonomous factors increased by less than liquidity-providing autonomous factors (Table A). Minimum reserve requirements rose by €3 billion to €167 billion, having only a marginal effect on the change in aggregate liquidity needs.

Liquidity-absorbing autonomous factors increased by €61 billion over the review period, owing mainly to a rise in other autonomous factors. On average, net other autonomous factors grew by €63 billion. This was due primarily to an increase of around €79 billion in the revaluation accounts as a result of higher gold prices (see the paragraph on liquidity-providing autonomous factors below), which was partially offset by a decrease in capital and reserves following the losses in 2024. Government deposits fell slightly by €2 billion to €109 billion. The overall decrease in this item since 2022 reflects the normalisation of cash buffers held by national treasuries and changes in the remuneration of government deposits held with the Eurosystem that have made it financially more attractive to place funds in the market. The average value of banknotes in circulation was stable over the review period, at €1,569 billion. Banknote demand continued to be broadly stable, having peaked in July 2022.

Liquidity-providing autonomous factors rose by €133 billion, owing primarily to an increase of €85 billion in net foreign assets. This rise in net foreign asset holdings was driven mainly by higher gold prices. Net assets denominated in euro grew by €48 billion over the review period.

Table A

Eurosystem liquidity conditions

Liabilities

(averages; EUR billions)

Source: ECB.

Notes: All figures in the table are rounded to the nearest €1 billion. Figures in brackets denote the change from the previous review or maintenance period.

1) Computed as the sum of the revaluation accounts, other claims and liabilities of euro area residents, and capital and reserves.

2) Memo item that does not appear on the Eurosystem balance sheet and should therefore not be included in the calculation of total liabilities.

Assets

(averages; EUR billions)

Source: ECB.

Notes: All figures in the table are rounded to the nearest €1 billion. Figures in brackets denote the change from the previous review or maintenance period. MROs stands for main refinancing operations, LTROs for longer-term refinancing operations and TLTRO III for the third series of targeted longer-term refinancing operations.

1) With the discontinuation of net asset purchases, the individual breakdown of outright portfolios is no longer shown.

Other liquidity-based information

Source: ECB.

Notes: All figures in the table are rounded to the nearest €1 billion. Figures in brackets denote the change from the previous review or maintenance period.

1) Computed as the sum of net autonomous factors and minimum reserve requirements.

2) Computed as the difference between autonomous liquidity factors on the liabilities side and autonomous liquidity factors on the assets side. For the purposes of this table, items in the course of settlement are also added to net autonomous factors.

3) Computed as the sum of current accounts above minimum reserve requirements and the recourse to the deposit facility minus the recourse to the marginal lending facility.

Interest rate developments

(averages; percentages and percentage points)

Sources: ECB, CME Group and Bloomberg.

Notes: Figures in brackets denote the change in percentage points from the previous review or maintenance period. MROs stands for main refinancing operations and €STR for euro short-term rate.

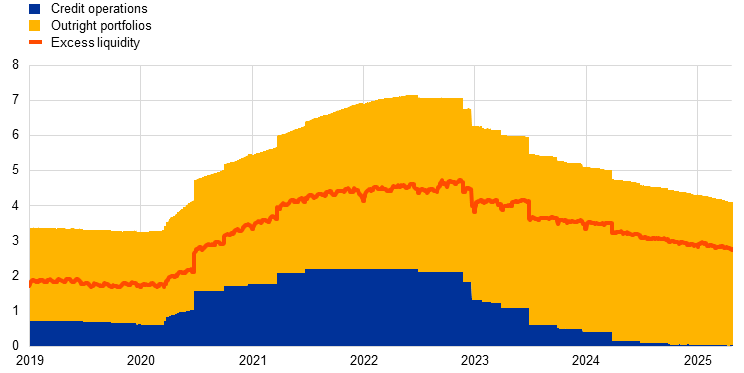

Liquidity provided through monetary policy instruments

The average amount of liquidity provided through monetary policy instruments decreased by €162 billion to €4,185 billion over the review period (Chart A). The decline in liquidity supply was driven primarily by a reduction in Eurosystem outright portfolios and, to a lesser extent, in credit operations.

Chart A

Changes in daily liquidity provided through open market operations and excess liquidity

(EUR trillions)

Source: ECB.

Note: The latest observations are for 22 April 2025.

The average amount of liquidity provided through outright portfolio holdings decreased by €147 billion to €4,159 billion over the review period. This decline was due to the continued maturing of APP and PEPP holdings in the absence of any reinvestments.[1]

The average amount of liquidity provided through credit operations fell by €14 billion to €26 billion over the review period. This decrease was largely due to the reduction in outstanding TLTRO III amounts following the maturing of the last TLTRO III operation on 18 December 2024 (€29 billion). The average outstanding amount of main refinancing operations (MROs) fell slightly by €1 billion to €9 billion, while the outstanding amount of three-month longer-term refinancing operations (LTROs) rose slightly by €2 billion to €16 billion. Banks’ relatively limited participation in these regular operations, despite the TLTRO repayments, reflects their comfortable liquidity position in aggregate and the availability of alternative funding sources at attractive market rates and maturities.

Excess liquidity

Average excess liquidity decreased by €92 billion over the review period to stand at €2,830 billion (Chart A). Excess liquidity is the sum of bank reserves held in excess of minimum reserve requirements and banks’ recourse to the deposit facility net of their recourse to the marginal lending facility. It reflects the difference between the total liquidity provided to the banking system via monetary policy instruments and the liquidity needed by banks to cover their minimum reserves. Having peaked at €4,748 billion in November 2022, excess liquidity has since declined steadily.

Interest rate developments

During the review period the Governing Council twice decided to cut all three key ECB interest rates – including the deposit facility rate, through which it steers the monetary policy stance – by 25 basis points. This brought the rates on the deposit facility, MROs and marginal lending facility down to 2.25%, 2.40% and 2.65% respectively with effect from the day immediately after the end of the review period.

The evolution of the average euro short-term rate (€STR) over the review period reflected the ECB’s rate cuts, while maintaining a negative spread relative to the deposit facility rate. On average, the €STR was 8.4 basis points below the deposit facility rate over the review period, remaining unchanged compared with the seventh and eighth maintenance periods of 2024. The pass-through of policy rate changes to unsecured money market rates was complete and immediate.

The pass-through of policy rate changes to repo rates was also smooth and immediate. The average euro area repo rate, as measured by the RepoFunds Rate Euro index, remained closer to the deposit facility rate than to the €STR. On average, the repo rate was 1.3 basis points below the deposit facility rate over the review period, whereas it was 2.6 basis points below it in the seventh and eighth maintenance periods of 2024. The continued gradual narrowing of the spread between repo rates and the deposit facility rate reflects the increasing availability of collateral as a result of higher net issuance, the release of collateral pledged against maturing/repaid TLTROs and the decline in the Eurosystem APP and PEPP holdings. Higher demand from leveraged investors to finance long positions in bonds further contributed to the upward pressure on repo rates.

Securities held in the outright portfolios are carried at amortised cost and adjusted at the end of each quarter, which has a marginal impact on the changes in the outright portfolios.