Published as part of the ECB Economic Bulletin, Issue 4/2025.

This box summarises the findings of a recent ECB survey of leading non-financial companies on the outlook for business investment.[1] The survey, carried out between 7 April and 14 May, asked firms about recent and expected euro area and global investment decisions and the factors driving or constraining these. Responses were received from 64 companies with an aggregate global revenue equivalent to almost 4% of euro area GDP. Of these, 39 are mainly active in the industrial sector, while the other 25 focus primarily on services.

The responding firms see a more subdued outlook for euro area investment ahead than in 2025 (Chart A). Asked how their investment budgets had evolved in 2025 compared to 2024, significantly more firms reported increases than decreases. However, over the next three years, 40% expected investment to remain broadly constant, with the numbers of firms expecting their investment to decrease or increase being roughly equal. This subdued outlook mainly reflects the feedback from industrial firms, one-third of which expected their investment in the euro area to decline over the next three years, while only a quarter expected it to increase.

Chart A

Investment in the euro area: current and evolution over the next three years

(percentages of responding firms)

Source: ECB.

Note: The chart depicts responses to the questions “How has your total investment budget in the euro area evolved in 2025 compared to 2024?” and “How do you expect your investment in the euro area to evolve over the next three years?”.

The subdued outlook for investment in the euro area contrasts with expectations of increasing investment in other geographical areas (Chart B). Almost two-thirds of the surveyed firms’ current investment is located in the euro area, around 5% in other EU economies and around one-sixth each in other advanced economies and emerging markets.[2] Net responses indicate expectations of near stagnation in euro area business investment over the next three years, but increasing investment outside the euro area, especially in non-EU advanced economies and emerging markets. The subdued investment outlook for the euro area relative to other advanced economies and emerging markets reflects industrial firms’ expectations of contracting investment in the euro area, but growing investment outside the euro area. By contrast, services firms expected increasing investment both inside and outside the euro area, and at more similar rates. Demand was the main factor influencing the geographical focus of investment, ahead of higher growth opportunities and the desire to enter new markets. Other frequently cited factors relate to the wish to diversify and build supply chain resilience, proximity to customers (“local-for-local”), different tariffs, more favourable regulation, and economic and political stability.[3]

Chart B

Investment by region: evolution over the next three years

(percentage changes)

Source: ECB.

Notes: The chart depicts responses to the question “How do you expect your investment in the following geographical areas to evolve over the next three years?”. Expected investment is derived by aggregating the shares of firms replying “decrease by more than 20%” (rounded to -20%), “decrease by 5-20%” (averaged to -12.5%), “roughly the same (±5%)” (averaged to 0%), “increase by 5-20%” (averaged to 12.5%), and “increase by more than 20%” (rounded to 20%).

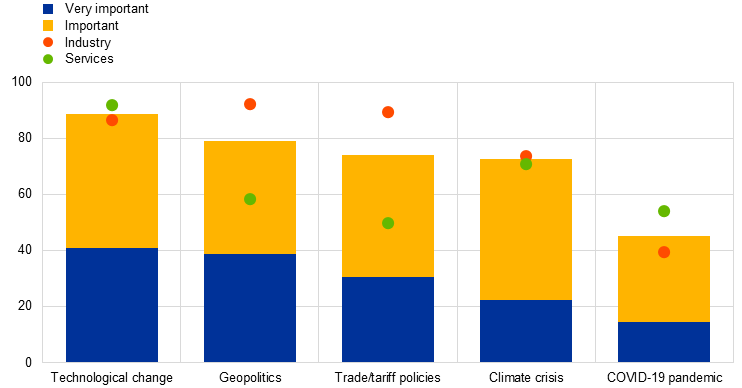

Technological change and evolving geopolitics have become key considerations for firms’ investment strategies (Chart C). Asked about the importance of five major recent developments and events in causing firms to rethink their global investment strategies in recent years, technological change ranked highest in the full sample. For industrial companies, geopolitics and trade/tariff policies were deemed slightly more important than technological change, with firms in the services sector less exposed to these forces. The climate crisis also scored relatively highly, while the COVID-19 pandemic was considered somewhat less important (at least in retrospect).[4]

Chart C

Importance of major developments and events of the 2020s in causing firms to rethink their investment strategies

(percentages of responding firms)

Source: ECB.

Notes: The chart depicts responses to the question “How important have the following major developments and events been in causing you to re-think your global investment strategy in recent years?”. Bars relate to percentages of all 64 firms responding to the survey. Dots show combined percentages for “important” and “very important” factors by sector.

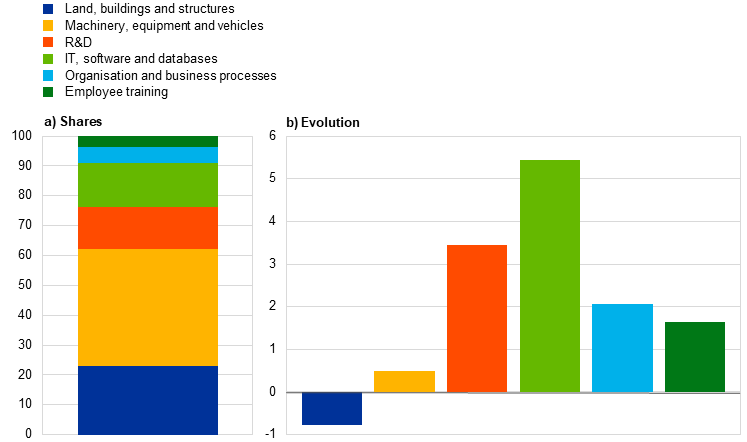

The responding firms expect their euro area investment over the next three years to be driven mainly by intangibles, especially IT, software and databases. On average, firms reported that around 60% of their investment expenditure in the euro area was on “tangibles” (such as machinery and equipment); 30% on “intangibles” (research and development (R&D) and IT, software and databases), which are typically allocated to operational expenditure in company accounts but are counted as investment in national accounts; and 10% on organisation and business processes and employee training (Chart D, panel a). Over the next three years, firms expected their tangible investment to broadly stagnate, while expenditure on R&D and, in particular, on IT, software and databases was expected to increase (Chart D, panel b).

Chart D

Investment by asset: shares in 2025 and evolution over the next three years

(panel a: percentages of total investment in 2025; panel b: percentage changes over the next three years)

Source: ECB.

Notes: The chart depicts responses to the questions “Of your total euro area investment, roughly what share is dedicated to each of the following areas?” and “How do you expect your euro area investment in each of these areas to evolve over the next 3 years?”. Evolution over the next three years is derived by aggregating the shares of firms replying “decrease by more than 20%” (rounded to -20%), “decrease by 5-20%” (averaged to -12.5%), “roughly the same (±5%)” (averaged to 0%), “increase by 5-20%” (averaged to 12.5%), and “increase by more than 20%” (rounded to 20%).

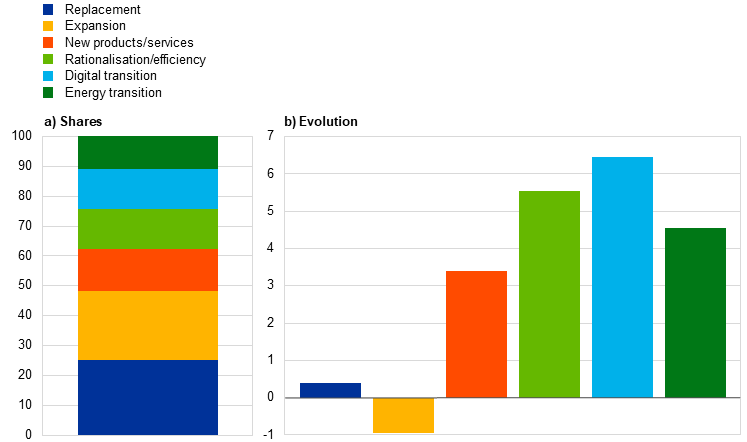

The focus on intangible investment likely reflects increasing prioritisation of the digital and energy transitions, as well as rationalisation and efficiency. On average, respondents categorised around half of their investment as being focused on replacement and expansion, with the remainder, in broadly equal measure, dedicated to the development of new products, rationalisation and efficiency objectives, the digital transition, and the energy transition (Chart E, panel a).[5] Over the next three years, the strongest driver of current investment plans was expected to be the digital transition, followed by rationalisation and efficiency, the energy transition, and the development of new products and services (Chart E, panel b).

Chart E

Investment by purpose: shares in 2025 and evolution over the next three years

(panel a: percentages of total investment in 2025; panel b: percentage changes over next three years)

Source: ECB.

Notes: The chart depicts responses to the questions “Of your total euro area investment, roughly what share is dedicated to each of the following purposes?” and “How do you expect your euro area investment for each of these purposes to evolve over the next 3 years?”. The sum of the shares reported by firms has been rescaled to 100% (the total exceeded 100% as some responses reflected the multiple purpose of some investments). The evolution over the next three years is derived by aggregating the shares of firms replying “decrease by more than 20%” (rounded to -20%), “decrease by 5-20%” (averaged to -12.5%), “roughly the same (±5%)” (averaged to 0%), “increase by 5-20%” (averaged to 12.5%), and “increase by more than 20%” (rounded to 20%).

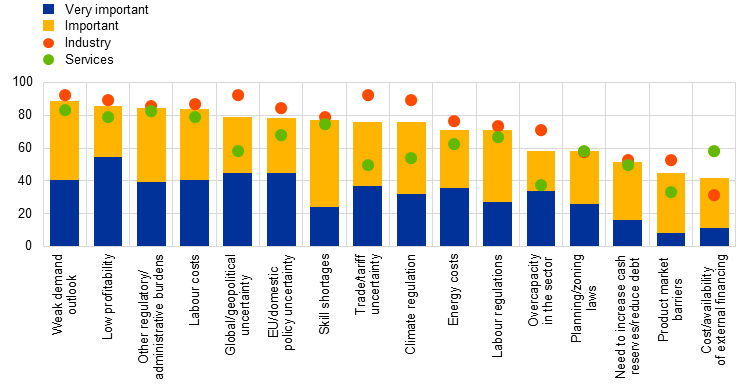

A weak demand outlook and low profitability top the list of constraints on euro area investment (Chart F). Nine out of ten respondents reported weakness in demand as the most important (often “very important”) constraint on euro area investment, closely followed by low profitability, other regulatory and administrative burdens, and labour costs (cited by 80-85% of firms).[6] Among industrial firms, global geopolitical uncertainty, trade uncertainty and EU/domestic policy uncertainty featured particularly strongly. Asked about what changes could be expected to encourage higher investment in the euro area, more than half of the respondents pointed to lower and/or more stable regulation. A more growth-friendly and predictable climate policy also featured strongly, as well as more demand stimulus, political and economic stability, and lower labour and energy costs. The cost and availability of external financing was deemed of much lower importance, probably reflecting in part the easier availability of external finance for the large firms surveyed than for smaller firms.

Chart F

Factors constraining investment in the euro area

(percentages of responding firms)

Source: ECB.

Notes: The chart depicts responses to the question “How important are the following factors in constraining your investment in the euro area?”. Bars relate to percentages of all 64 firms responding to the survey. Dots show combined percentages for “important” and “very important” factors by sector.

Anticipated increased defence spending is quite widely perceived as a potential catalyst for investment. Half of the industrial firms and a fifth of services respondents expected increased defence spending to support their investment over the next three years. These firms tended to be supplying the defence industry already (directly or indirectly), or exploring or intending to explore opportunities to adapt current production to growth opportunities related to recent defence spending announcements, or they expected to benefit indirectly from the resulting boost in overall economic activity. By comparison, only around one in five respondents (predominantly firms based in southern Europe) perceived the Next Generation EU programme as having supported investment in their sector. Where support was perceived, it tended to be focused on projects related to environmental and digital infrastructure.

The survey was sent to firms with which the ECB maintains regular contacts for the purpose of gathering business intelligence, as explained in the article entitled “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2021.

The industrial firms surveyed are on average more global, with only half of their investment in the euro area and around one-fifth each in non-EU advanced economies and emerging markets. The activities of the services firms are on average more concentrated, with three quarters of their investment in the euro area and around one-tenth each in non-EU advanced economies and emerging markets.

For earlier findings from a similar survey in relation to diversification, supply chain resilience and proximity to customers, see the box entitled “Global production and supply chain risks: insights from a survey of leading companies”, Economic Bulletin, Issue 7, ECB, 2023.

However, according to regular contacts with firms at the time, the pandemic did lead to a considerable reorganisation of supply chains and a growing shift from “just in time” to “just in case” inventory strategies.

It should be noted that many investments have more than one purpose, and identifying the purpose of investments using the categories listed may be rather subjective.

Labour regulations and climate regulation were listed as separate factors in the questionnaire.