3 July 2025

European and national authorities have joined forces with banks to integrate reporting requirements across Europe. This will reduce costs for banks and improve data quality. In this blog post we describe the European integrated reporting initiative and present some initial results.

Collecting data from banks is essential for authorities to conduct monetary policy, supervision and resolution. But banks in Europe are facing more and more regulatory reporting requirements from various European and national authorities. These requirements often differ in terms of definitions, reporting deadlines and templates. For banks, this lack of harmonisation makes reporting unnecessarily burdensome; for authorities, it complicates sharing and analysing data.

In the context of the European initiative on integrated reporting, the European Banking Authority (EBA) and the European Central Bank (ECB) established the Joint Bank Reporting Committee (JBRC) in March 2024. Our goal is to harmonise and simplify banks’ reporting of statistical, supervisory and resolution data, working in close collaboration with the banking industry.[1] This initiative fundamentally enhances the European approach to banks’ data reporting. Harmonising reporting standards will reduce the reporting burden on banks and enhance data quality. This aligns with the European Commission’s simplification initiative aimed at boosting Europe’s competitiveness.

Joint Bank Reporting Committee paves way for integrated reporting

The JBRC brings together high-level representatives from European and national authorities to explore ways of making banks’ reporting more efficient. It provides, for example, advice on how to harmonise definitions and reporting deadlines and how to share data among authorities more efficiently (Figure 1), thus enabling banks to avoid double reporting. Ideally, data would only be reported by banks once and could then be shared and reused by all authorities.

Figure 1

Key responsibilities of the JBRC

The JBRC consists of the ECB, the EBA, the European Commission and the Single Resolution Board, as well as the national authorities that issue supervisory, resolution and statistical reporting requirements in the European Economic Area (Figure 2).

To ensure close collaboration with the banks, we have set up a reporting contact group (RCG) composed of data reporting experts from the banking industry. The RCG holds joint meetings with the JBRC Steering Committee, which coordinates the JBRC’s activities. These meetings provide a forum for authorities and reporting banks to cooperate and exchange views. In addition, hands-on cooperation can take place within the JBRC expert groups, which include technical experts from the banking industry and look more closely at the technical details of banks’ reporting. The RCG will share with the authorities their practical insights on how to formulate reporting requirements. The authorities will continue to determine, depending on their policy needs, what the banks must report.

Figure 2

JBRC composition

Moving towards integration: long-term vision

The EBA’s feasibility study on integrated reporting put forward a long-term vision for moving from the current system of supervisory reporting by financial institutions to a modern, efficient and effective reporting process.[2]

The JBRC was established as part of that long-term vision and has also begun work on other key areas for achieving fully integrated reporting of statistical, supervisory and resolution data.

First steps towards integrated reporting

The JBRC has already produced some tangible results towards more integrated reporting. Its work programme for 2025 prioritises work on common terms and definitions. It also focuses on the harmonised implementation of the revision of the statistical classification of economic activities in the European Union (abbreviated as NACE).

Harmonising implementation of statistical revisions

Banks use NACE to classify in their regulatory reporting the kind of counterparties they do business with. The European Commission updated NACE in October 2022. Banks still report data using the previous NACE classification but will eventually have to switch to the new version. Ideally, this shift will happen for all reporting at the same time in order to avoid parallel reporting using different classification systems. The JBRC therefore advised that the NACE revision should be implemented across the European banks’ reporting frameworks simultaneously as of January 2026.[3] The EBA and the ECB have already committed to this new implementation date. The JBRC encourages national central banks to follow the same implementation date for any national statistical data collections in which the NACE classification is used.

Using the same language in reporting

Another important task is to develop a common data dictionary that defines the meaning and structure of the data to be reported. For this purpose, the JBRC has set up an Expert Group on Semantic Integration, which gives advice on how to harmonise definitions of concepts – called semantics – used in reporting requirements. One focus of this group will be to give preliminary advice to the authorities on new, upcoming legislation, since definitions in draft legislation are easier to revise than definitions that are already firmly enshrined in law.

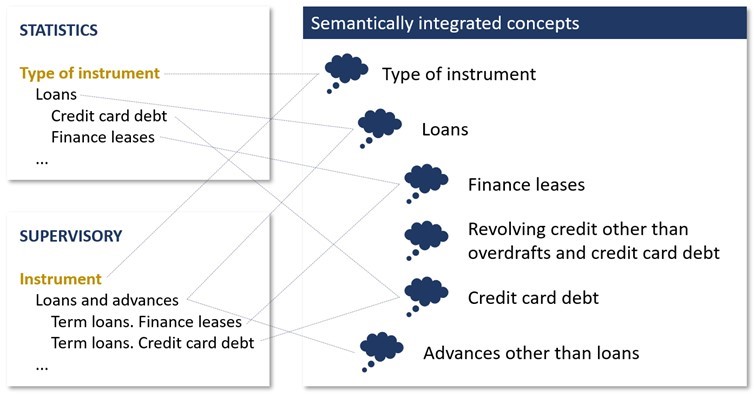

Semantic integration is the process of aligning different reporting frameworks. This is done by identifying and linking elements that represent the same concepts and by standardising the terms and definitions. In the example in Figure 3, the statistical concept “Type of instrument” matches the supervisory concept “Instrument”. With semantic integration, we establish a uniquely defined concept (“Type of instrument”) for both statistical and supervisory reporting. This concept is broken down into its constituent components, in the form of a hierarchy, with mapping across the two reporting frameworks. Having uniquely defined concepts significantly reduces the reporting burden.

Figure 3

Simplified example of semantic integration

One of the high priority activities in 2025 is the semantic alignment of the Eurosystem’s Integrated Reporting Framework (IReF) with other banking data collection frameworks, in particular financial reporting (FinRep) used for supervisory purposes. The IReF is currently scheduled to enter into force by the end of 2029. It will integrate several statistical ECB regulations into one regulation. This will help remove overlaps and harmonise reporting deadlines within the Eurosystem.[4]

In the coming months, the group will start working on the semantic integration of sustainability reporting, while also exploring further potential synergies with other frameworks, such as resolution reporting. These requirements would benefit from harmonised concepts and definitions and, together with the work on the IReF, will ultimately contribute to the creation of a common data dictionary and to the definition of the next steps towards a fully integrated reporting framework. While semantic integration is the current priority, the JBRC is also laying the groundwork for broader progress across all key areas identified in the EBA’s feasibility study. The focus on semantic integration represents an important and constructive first step, creating a solid foundation to achieve fully integrated reporting of statistical, supervisory and resolution data.

Conclusion

Integrated reporting of statistical, supervisory and resolution data by banks would make bank reporting more efficient and improve data quality. It would also address past inconsistencies and redundancies, ensuring that such issues can be avoided in future legislation. The JBRC has made some promising first steps in this direction. It will continue to work in close collaboration with the banking industry to achieve our goal of truly integrated reporting in Europe.

Check out The ECB Blog and subscribe for future posts.

For topics relating to banking supervision, why not have a look at The Supervision Blog?

ECB (2024), “ECB and EBA step up efforts to make banking industry data reporting more efficient”, press release, 18 March.

EBA (2021), “The EBA’s feasibility study on integrated reporting system provides a long-term vision for increasing efficiencies and reducing reporting costs”, press release, 16 December.

Joint Bank Reporting Committee (2025), Advice on the implementation of the revised statistical classification of economic activities (NACE Rev. 2.1), 30 June.

ECB (2025), Integrated Reporting Framework (IReF).